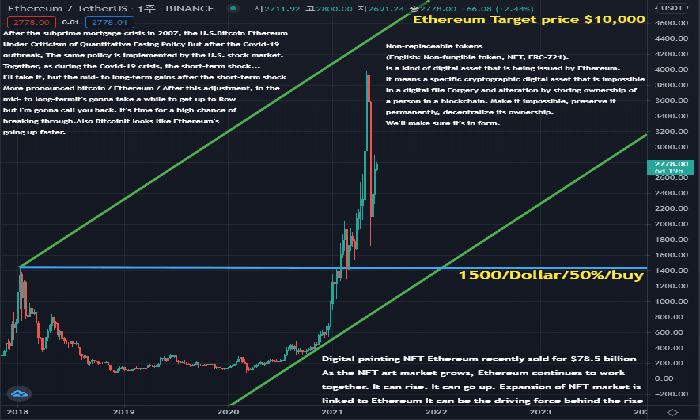

Understanding the Ethereum price target is critical for investors navigating the ever-evolving landscape of cryptocurrency. As Standard Chartered recently revised its 2025 price prediction for Ethereum from $10,000 to a more conservative $4,000, it signals the potential impact of market trends on ETH’s value. Analysts at Standard Chartered point to Coinbase’s proactive selling of Ethereum, amounting to approximately $37 million in Q4 2024, as a significant factor contributing to this decline. Such moves have raised concerns about the future of Ethereum amidst ongoing profit-taking by major exchanges. With these shifting dynamics, an analysis of Ethereum price trends and the broader market context becomes essential for those seeking to understand upcoming cryptocurrency price predictions.

Exploring the anticipated value of Ethereum requires a look at the current market sentiment surrounding this popular blockchain platform. Recent insights from financial experts, particularly concerning Coinbase’s Ethereum activities, reveal a crucial element affecting the projected Ethereum price outlook. The latest research underscores that profit realizations by cryptocurrency exchanges can considerably alter price trajectories, challenging optimistic forecasts. Moreover, the broader cryptocurrency ecosystem’s fluctuations, particularly concerning transacting via layer-2 solutions like Coinbase’s Base, sheds light on the complexities of Ethereum’s market performance. These aspects holistically frame the ongoing discourse around Ethereum’s future valuation and market viability.

Impact of Coinbase’s Ethereum Sales on Market Trends

Coinbase’s decision to sell a significant amount of Ethereum, totaling approximately $37 million in Q4 2024, has raised concerns among analysts regarding the stability of Ethereum’s price movement. This proactive selling strategy by Coinbase reflects a broader trend of profit-taking that is directly influencing the cryptocurrency market. As Coinbase operates a vital layer-2 network, Base, which boosts demand for ETH, the sales lead to a paradox where the demand generated is countered by the supply introduced through these sales, causing fluctuations in Ethereum’s price.

Moreover, this action signals a potential structural change within the Ethereum ecosystem. As profit-taking becomes a recurring strategy for Coinbase, the detrimental effects on the price of Ethereum are likely to reverberate through the market. The recent analysis from Standard Chartered underscores the correlation between these sales and the significant reduction in Ethereum’s market cap, highlighting the intricacies of cryptocurrency price prediction as market players respond to Coinbase’s business strategies.

Frequently Asked Questions

What is the current Ethereum price target according to Standard Chartered?

Standard Chartered has recently revised its Ethereum price target for 2025 from $10,000 down to $4,000, citing factors such as profit-taking by cryptocurrency exchanges like Coinbase and overall market trends affecting Ethereum’s valuation.

How did Coinbase’s sales impact Ethereum’s price target?

Coinbase proactively sold approximately 12,652 Ethereum, amounting to about $37 million in Q4 2024. This selling activity contributed to Standard Chartered’s reduction of the price target for Ethereum, highlighting how such actions influence market trends and price movements for ETH.

What are the main factors affecting Ethereum’s price as outlined in recent analysis?

Recent Ethereum price analysis indicates that profit-taking by platforms like Coinbase significantly affects ETH’s price stability. Additionally, market trends, including the performance of layer-2 networks like Base, and the Ethereum-to-Bitcoin ratio, play crucial roles in shaping price predictions.

What did Geoff Kendrick state about Ethereum’s future market performance?

Geoff Kendrick, the Global Head of Digital Assets Research at Standard Chartered, stated that he expects Ethereum’s price to face a structural decline throughout 2025. He noted that the activity on the Base layer-2 network generates initial demand but leads to profit-taking that undermines long-term price stability.

How does Coinbase’s Ethereum strategy relate to its price predictions?

Coinbase’s strategy of selling a significant amount of Ethereum profits, as seen in their Q4 actions, indicates a pattern of risk-adjusted profit maximization, which directly affects Ethereum’s market value and price predictions as analyzed by Standard Chartered.

What are the predicted trends for Ethereum in relation to Bitcoin?

Market forecasts suggest that the ETH-to-BTC ratio is expected to continue declining, indicating that even if Ethereum experiences price increases, its relative strength against Bitcoin may diminish through 2027.

How does Ethereum’s layer-2 network Base influence the price target?

The Base layer-2 network, developed by Coinbase, initially boosts demand for Ethereum. However, as profits from the network are frequently sold to realize gains, it has led to a diminished demand for ETH in the long run, contributing to Standard Chartered’s downward revision of the 2025 price target.

What impact do gas fees have on Ethereum’s price analysis?

Gas fees are crucial for Ethereum’s economic model. A decline in gas fees, attributed to increased use of layer-2 networks like Base, suggests lower earnings for the Ethereum Foundation, potentially impacting Ethereum’s market cap and price forecasts negatively.

Will Ethereum’s price recover from Standard Chartered’s revised target?

While Standard Chartered’s revised price target for Ethereum is lower, market data from platforms like CoinGecko shows that ETH has experienced some recent gains. Therefore, whether Ethereum can recover its price will depend on future market dynamics and investor sentiment.

| Point | Details |

|---|---|

| Sale of Ethereum | Coinbase sold 12,652 Ethereum valued at approximately $37 million in Q4 2024. |

| Revised Price Target | Standard Chartered reduced its 2025 price target for Ethereum from $10,000 to $4,000. |

| Profit-Taking Impact | Profit-taking from Coinbase’s Ethereum sales negatively affects Ethereum’s price movement. |

| Market Dynamics | Coinbase’s layer-2 network Base has removed $50 billion from ETH’s market cap due to profit-taking. |

| Analysis of Transactions | Transactions via layer-2 networks contribute to lower fees for Ethereum, affecting overall earnings of the blockchain. |

| Future Outlook | Analysts predict a ‘structural decline’ in Ethereum’s price through 2025, despite a recent increase in price. |

Summary

The Ethereum price target forecast has been significantly impacted by the recent actions of Coinbase, particularly with their proactive selling of Ethereum. As per Standard Chartered’s analysis, this selling behavior is leading to a revised price target, decreased from $10,000 to $4,000 by 2025. The ongoing profit-taking and structural dynamics in the market are expected to continue affecting Ethereum’s price movement. As such, investors should take note of these developments when considering their strategies involving Ethereum.

Ethereum price target forecasts have recently undergone significant scrutiny, particularly with the latest insights from Standard Chartered. As the global cryptocurrency landscape continues to evolve, many investors are eager to understand how Ethereum price trends will influence their strategies. The multinational bank has notably reduced its 2025 price target for ETH, revising it from a lofty $10,000 to just $4,000, primarily due to profit-taking behaviors observed from significant channels like Coinbase. This has raised questions regarding the overall stability of Ethereum’s market performance and its future valuation. Investors are closely monitoring the implications of Coinbase’s proactive Ethereum sales and the bank’s Ethereum price analysis to better navigate the shifting tides of cryptocurrency price prediction.

In the realm of digital currencies, the anticipated valuation of Ethereum is drawing attention as financial experts express their forecasts. The recent adjustments to Ethereum price expectations indicate a potential decline in the otherwise bullish momentum once predicted for this blockchain technology. Standard Chartered’s analysis reflects a concerning shift in market behavior, emphasizing that Coinbase’s strategy of selling Ethereum holdings may hinder long-term growth. As cryptocurrency enthusiasts sift through Standard Chartered’s Ethereum market trends and consider the impact of such dynamics, alternative price projections are becoming crucial for investors looking to gauge the potential of this digital asset. Understanding these multifaceted perspectives is essential for anyone involved in cryptocurrency investments.