Bitcoin dominance plays a pivotal role in understanding the overall health and direction of the cryptocurrency market. As Bitcoin (BTC) continues to assert its position, reaching a dominance of 65%, investors are keenly observing how this influences the altcoin performance and overall market trends. With the impending Federal Reserve interest rates decision, many analysts are busy analyzing Bitcoin price predictions that could reshape market dynamics. The recent surge in BTC dominance mirrors both excitement and caution among traders as they navigate the shifting landscape of digital currencies. As we delve deeper into the causes and implications of Bitcoin dominance, it becomes clear that this metric is more than just a number; it’s a signal of market confidence and potential volatility ahead.

The concept of Bitcoin dominance, often referred to as BTC market share, is crucial for quantifying the leading cryptocurrency’s influence within the entire digital asset ecosystem. As the cryptocurrency market evolves, the balance between Bitcoin and alternative coins (altcoins) fluctuates, creating interesting performance patterns that traders closely monitor. With key economic factors, such as Federal Reserve monetary policy and interest rates, impacting market behavior, Bitcoin’s prevailing share provides insights into future trends. Investors are particularly interested in Bitcoin price forecasts as they relate to market sentiment and potential altcoin spikes. Ultimately, understanding BTC’s dominance helps in predicting shifts within the cryptocurrency landscape.

Understanding Bitcoin Dominance in the Current Market

Bitcoin dominance, a measure of Bitcoin’s market capitalization relative to the overall cryptocurrency market, has recently seen an increase to around 65%. This surge indicates that BTC is reclaiming its position as the dominant cryptocurrency, reflecting a potential shift in investor sentiment toward Bitcoin amid ongoing volatility in the crypto space. As altcoins face fluctuations, many investors are turning to Bitcoin for perceived stability, especially with the Federal Reserve’s interest rate decisions looming over the markets. It’s essential to comprehend how Bitcoin dominance impacts market trends, as higher dominance can lead to increased attention on Bitcoin, potentially displacing altcoins in terms of investment flows.

However, it’s crucial to navigate the nuances of Bitcoin dominance, as historical patterns show that such increases are often temporary. Analysts are cautioning that if Bitcoin’s dominance escalates beyond the 71% mark, it may signify an impending pullback, resulting in an altcoin market comeback. With altcoin performance being closely watched, investors must stay informed about how shifting dynamics in BTC dominance correlate with broader market trends. As the industry matures, the correlation between Bitcoin’s performance and altcoin movements becomes ever more intricate.

Analysis of Bitcoin Price Predictions Amidst Market Events

As Bitcoin price predictions become increasingly critical with market fluctuations, the influence of external factors like Federal Reserve interest rates cannot be ignored. Analysts are projecting a cautious outlook in the lead-up to the Fed’s May 7 meeting, where investors are eager to gauge the potential impact on Bitcoin prices. Recent trading activity has shown significant buying interest around the $93,500 level, indicating that many believe this could act as a strong support point. If Bitcoin can hold above this level, it may attract more bullish sentiment and eventually lead to a price rally, potentially reclaiming higher territories as traders react to upcoming economic news.

Market analysts, however, remain divided on Bitcoin’s trajectory over the short and medium term. While some predict a potential price surge toward the $97,000 mark due to positive market liquidity, others caution about volatility stemming from upcoming jobless claims reports. Divergent views emphasize the importance of aligning Bitcoin price predictions with broader economic indicators, as traders parse through data to determine possible price movements. This makes monitoring Bitcoin’s movement relative to key resistance levels essential for predicting future trends.

Impact of Federal Reserve Decisions on Bitcoin and the Crypto Market

The Federal Reserve’s interest rate decision is set to have a significant impact on Bitcoin and the cryptocurrency market as a whole. With expectations firmly in place for hawkish language from Fed Chair Jerome Powell, traders are preparing for volatility that could send Bitcoin prices oscillating between support and resistance levels. Historically, low interest rates have favored cryptocurrency investments, making the looming decisions particularly significant for Bitcoin’s price predictions. As traders position themselves ahead of the announcement, the community must be wary of potential market corrections based on the Fed’s communications.

Furthermore, the market’s reaction to the Fed’s announcements could further influence BTC dominance and volatility in the altcoin sector. Anticipated rate hikes could erode interest in risk-on assets, such as cryptocurrencies, which may adversely affect Bitcoin’s ability to maintain its dominance. Investors must be vigilant as these macroeconomic factors play a decisive role in shaping cryptocurrency market trends, particularly around periods of heightened uncertainty.

Economic Sentiment and Bitcoin’s Resilience Against Recession

Economic sentiment plays a pivotal role in shaping Bitcoin’s performance, especially as recession concerns loom large. With a reported 72% likelihood of recession among consumers, the sentiment shift can have adverse effects on investor behavior. Bitcoin, often perceived as a safe haven in times of economic distress, may attract more buyers if traditional markets weaken. As traders seek alternative assets to hedge against inflation and currency devaluation, Bitcoin’s resilience could bolster its dominance against the backdrop of economic uncertainty.

However, it’s essential to consider how such recessionary fears might affect altcoin performance as well. Historical patterns indicate that during economic downturns, investors may gravitate towards Bitcoin, sidelining altcoins perceived as higher-risk investments. Thus, strong gains in BTC dominance could signal to strategists within the cryptocurrency community to reevaluate their positions towards altcoins amidst a potentially volatile economic landscape.

Current Trends in Bitcoin Dominance and Altcoin Market Dynamics

As Bitcoin dominance has climbed to 65%, the discussions surrounding its implications for altcoin performance intensify. Analysts suggest that significant milestones and various market conditions could lead to a possible collapse of BTC’s dominance, particularly with rising institutional interest in Bitcoin. This renewed focus on Bitcoin could siphon off liquidity from altcoins, causing them to stagnate or decline as investors flock to BTC for potential safety and returns. Understanding these trends is critical for traders looking to optimize their portfolios in this ever-evolving economic environment.

Moreover, the interaction between Bitcoin dominance and altcoin performance indicates a continually shifting paradigm within the cryptocurrency market. As Bitcoin solidifies its position, altcoins may begin to show signs of recovery, especially if traders witness a stabilizing trend in Bitcoin prices. Cryptocurrency markets are renowned for their volatility, and as traders become increasingly dynamic, coin performance relative to Bitcoin may dictate future investment strategies. Monitoring Bitcoin’s influence on altcoins provides valuable insight into potential trading opportunities, especially during pivotal moments like the current regulatory atmosphere.

Frequently Asked Questions

What recent trends have influenced Bitcoin dominance in the cryptocurrency market?

Recent trends indicate that Bitcoin dominance has surged to 65%, reflecting increased market interest amid economic uncertainties, particularly surrounding the Federal Reserve’s interest rate decisions. This surge in BTC dominance has been driven by cautious investor sentiment and the belief that Bitcoin could serve as a safe haven during volatile times.

How do Federal Reserve interest rates affect Bitcoin price prediction and Bitcoin dominance?

Federal Reserve interest rates play a crucial role in shaping Bitcoin price predictions and dominance levels. Higher interest rates can dampen risk appetite, potentially leading to declines in cryptocurrency markets. Conversely, a stable or lower interest rate environment could bolster Bitcoin’s appeal, allowing its dominance to rise further as investors flock to perceived safer assets.

What implications does a drop in BTC dominance have for altcoin performance?

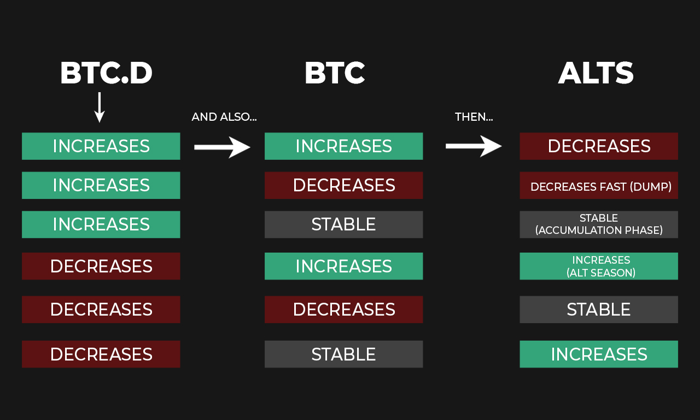

A drop in BTC dominance often signals a burgeoning altcoin market, as investors may start reallocating funds into alternative cryptocurrencies. As Bitcoin’s dominance wanes, historical trends suggest that altcoins can experience notable rallies and increased performance, leading to speculative trading within the broader cryptocurrency market.

What role does Bitcoin’s dominance play in forecasting cryptocurrency market trends?

Bitcoin dominance serves as a vital indicator for forecasting cryptocurrency market trends. A rising BTC dominance typically indicates that Bitcoin is outperforming altcoins, while a declining dominance may signal strength in the altcoin market. Analysts often use BTC dominance metrics to gauge overall market sentiment and predict potential shifts among cryptocurrencies.

How might Bitcoin dominance impact future Bitcoin price stability?

Bitcoin dominance can significantly impact Bitcoin price stability. An increase in dominance often correlates with stronger price support for Bitcoin, providing a buffer against market volatility. Additionally, as institutional demand for Bitcoin grows, it could enhance price stability, reinforcing Bitcoin’s status as a leading asset in the cryptocurrency space despite external economic pressures.

| Key Point | Description |

|---|---|

| Market Overview | BTC begins May with focus on yearly opening support amidst key US economic policy changes. The Federal Reserve’s interest decision is highly anticipated, while fears of a recession are growing. |

| Bitcoin Price Watch | Selling pressure led to a low of $93,350, but bullish indicators suggest potential rebounds as liquidity gathers around $96,420. |

| Fed Interest Rate Decision Impact | The Federal Reserve’s May 7 decision on interest rates could induce volatility, with markets expecting hawkish stances. Traders are preparing for strategic entries based on rate outcomes. |

| Economic Sentiment and Recession Concerns | Concerns about a US recession are at a two-year high, influencing Bitcoin’s price sensitivity, particularly with upcoming employment data release. |

| Bitcoin Dominance Trends | Bitcoin’s dominance at 65% is the highest since 2021. Analysts predict potential decline under specific conditions but rising institutional demand could alter trends. |

Summary

Bitcoin dominance is currently at 65%, marking its highest level in over four years, with analysts cautiously optimistic about its future. The upcoming Federal Reserve interest rate decision, coupled with broader economic concerns, is expected to exert significant pressure on Bitcoin’s market position. As market volatility and sentiment shift, the balance between Bitcoin and altcoins will be crucial for traders to observe in the coming weeks.

In the ever-evolving landscape of cryptocurrencies, Bitcoin dominance stands at a crucial juncture, recently hitting 65% for the first time in over four years. This substantial dominance showcases Bitcoin’s resilience amid fluctuating market conditions and economic uncertainty, particularly as it gears up for the Federal Reserve’s interest rate decision. With analysts analyzing Bitcoin price predictions in light of macroeconomic factors, traders are keenly observing how BTC’s dominance impacts altcoin performance. As sentiments shift and excitement grows around Bitcoin, understanding BTC dominance becomes essential for grasping cryptocurrency market trends. The enduring question remains: will Bitcoin sustain this leading position, or are we on the brink of a shake-up in the altcoin arena?

Bitcoin’s market supremacy, often referred to as its dominance, has recently captured significant attention as it demonstrates remarkable resilience against other cryptocurrencies. Currently holding a commanding 65% share, this pivotal standing raises questions about future trends as economic signals loom large, especially with the Federal Reserve’s anticipated interest rate announcements. Many enthusiasts are turning to Bitcoin for their price forecasts, weighing its potential against challengers in the altcoin sector. Amid concerns about overall market dynamics, the interplay between Bitcoin and subsequent altcoin performance is crucial in determining where investors should focus their efforts. As such, understanding the current crypto environment is essential for anyone navigating these complex financial waters.