XRP price prediction has become a hot topic among crypto enthusiasts and investors alike, especially in light of recent developments surrounding Ripple Labs and its ongoing legal tussles with the SEC. Analysts are optimistic, forecasting that XRP could not only recover but also achieve astronomical valuations, potentially reaching four-digit prices. This surge is attributed to several factors, including regulatory clarity and increasing institutional interest in XRP as a primary currency for cross-border transactions. As news surfaces regarding major financial institutions preparing to adopt XRP, the anticipation builds, making the XRP forecast increasingly bullish. Furthermore, with a potential crypto price surge on the horizon, it’s critical to analyze XRP trading analysis closely, particularly in relation to the XRP legal case that may influence its future trajectory.

When considering the potential movements of Ripple’s digital asset, investors are eager for insights into the future of XRP. The discourse surrounding Ripple’s performance is often encapsulated in discussions about regulatory updates, market adoption, and technological advancements in the crypto space. Observers are closely examining the implications of XRP’s utility as a means for enhancing cross-border payment solutions. With many financial institutions signaling their readiness to incorporate XRP into their operations, the elevated interest underscores the expectations for a bullish XRP forecast moving forward. Notably, as more positive Ripple XRP news emerges, it shapes the market narrative and influences trading dynamics within the broader cryptocurrency landscape.

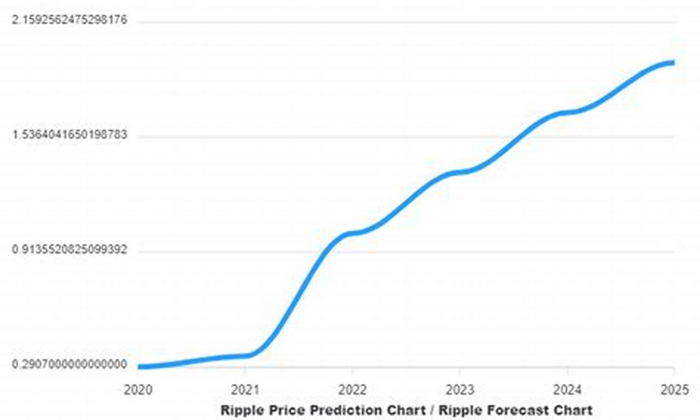

XRP Price Prediction: Will It Soar to $1000?

In a bold assertion, CryptoSensei predicts that XRP’s price could skyrocket to four or even five digits, hinging upon key developments in the regulatory landscape and institutional adoption. This Ethereum-rival is not just any cryptocurrency; it is infused with potential to revolutionize how financial institutions handle assets and conduct transactions. With the SEC’s legal battle looming large, the eventual clarification of XRP’s status will be a determining factor for its price trajectory in the coming months. If major financial institutions, like Bank of America and Wells Fargo, engage with XRP post-regulation, it could trigger a unprecedented surge in its market value.

Moreover, analytics teams are observing correlations between XRP’s adoption rate and its price movements. Increased partnerships with banks and financial institutions signal a shift towards institutional investment. Should this trend continue alongside a favorable resolution of the SEC case, we might witness a rapid price surge. The investor sentiment around XRP is strongly influenced by technical indicators and on-chain metrics that suggest a potential upside in price as the cryptocurrency gains mainstream acceptance.

The Ripple Lawsuit: Implications for XRP’s Future

The ongoing legal struggle between Ripple Labs and the SEC is pivotal in determining the future of XRP. CryptoSensei asserts that clearing up the ambiguity surrounding XRP’s classification as a security could pave the way for wider institutional engagement. The ramifications of this case could either bolster investor confidence leading to a price rally or further dampen market sentiment if the results remain unfavorable. As the SEC continues to navigate its approach to crypto regulations, the outcome of this lawsuit will resonate throughout the entire cryptocurrency market.

Additionally, the legal outcomes will likely influence other cryptocurrencies as governments worldwide observe how regulatory frameworks evolve. An infrastructure conducive to crypto innovation could, therefore, be established as a result of Ripple’s outcomes. If institutional players begin pouring capital into XRP in anticipation of regulatory clarity, it could spark a transformation in market dynamics, rendering XRP a leading asset in the crypto space.

Institutional Adoption of XRP: A Game-Changer

CryptoSensei highlights an essential aspect of XRP’s future: institutional adoption. Major banks like BNY Mellon are showing promising interest in tokenized asset management, which could drive XRP’s price upwards considerably. With traditional financial systems recognizing the importance of digital assets, underway projects could see XRP positioned as a key player, especially in cross-border payment solutions. Banks are reportedly ready to embrace XRP, but the hesitance stemming from regulatory uncertainties could delay large-scale implementation.

As more institutions speak out in favor of integrating cryptocurrencies into their operations, the liquidity and scalability of XRP are set to attract institutional investment. The onboarding of institutional capital is often the precursor to massive crypto price surges. With the global tokenization market potentially valued in the trillions, XRP could capture a significant portion of that growing demand, contributing to heightened price predictions as it solidifies its role in the evolving financial ecosystem.

Tokenization of Real-World Assets on XRP Ledger

Tokenization is becoming increasingly critical within the financial ecosystem, particularly as traditional assets move onto blockchain platforms. CryptoSensei points out that the XRP Ledger (XRPL) is uniquely poised to facilitate this trend based on its low transaction fees and integrated building functionalities. As corporations and institutions look to digitize assets, Ripple’s XRPL could emerge as a favored platform, creating a surge in use cases for XRP and thereby potentially inflating its value.

Furthermore, as Ripple continues to tokenize real-world assets, the potential for XRP to become a fundamental medium of exchange in those transactions grows stronger. The expansion of tokenized real estate, commodities, and even debt instruments on the XRPL reflects a robust future for XRP in the realm of digital finance. The increasing number of successful projects on the XRP Ledger indicates significant interest from both institutional and retail investors, which could very well lead to bullish price movements in the near future.

Interoperability and Liquidity for XRP

One of the critical advantages of XRP is its interoperability with various blockchain networks. CryptoSensei mentions the Axelar network’s importance in establishing bridges among over 55 different blockchains, which enhances the liquidity landscape for XRP. As more platforms integrate with XRPL, the ability to facilitate smooth asset swaps across different ecosystems is essential for fostering a liquid market, one that could drive up prices due to increased usage.

The inherent design of the XRP Ledger allows for seamless trading and liquidity provisioning enabled via decentralized exchange (DEX) functionalities. This innovation could provide XRP with a competitive edge as multi-asset tokenization becomes commonplace. If more users turn to XRP as a reliable medium for transactions, the overall demand—and subsequently, the price—could sharply increase, reflecting XRP’s potential to serve a vital role in the global economy.

Cross-Border Payment Solutions and Their Impact on XRP’s Value

Cross-border payment solutions are arguably the backbone of Ripple’s vision, and XRP serves as an efficient tool for facilitating these transactions. As highlighted by CryptoSensei, the ability of XRP to enable fast remittances at minimal costs positions it as an attractive alternative to traditional banking systems that often take days to process payments. With remittance markets worth billions globally, the demand for faster, cheaper transactions could propel XRP’s usage and drive its price upwards significantly.

As financial institutions recognize the advantages of adopting XRP for cross-border transactions, we are likely to see a shift in how these transfers are conducted. By eliminating middlemen and reducing fees, XRP can unlock more efficient pathways for global transactions, solidifying its role in the finance sector. If institutions begin embracing XRP as their go-to currency for international payments, this could result in an extensive rise in both adoption rates and XRP’s market valuation.

Collaborations with Key Global Institutions: Boosting XRP Adoption

CryptoSensei emphasizes Ripple’s strategic alliances with influential global institutions, such as the Bank for International Settlements (BIS) and major payment networks like Mastercard and SWIFT. These collaborations are testimony to the credibility of XRP as a blockchain solution for cross-border payments. Being highlighted alongside established financial powerhouses enhances Ripple’s visibility and could encourage more companies to adopt XRP into their operations.

Building partnerships with key global institutions paves the way for XRP to be utilized in mainstream financial systems, potentially leading to higher volumes and steadily increasing prices. By positioning itself as a necessary tool for the financial landscape, XRP is not just another cryptocurrency; it is becoming integral to the future of global transactions, and as institutional collaborations grow, so too will confidence in the asset.

The Future of Treasury Markets on XRP Ledger

The discussion around tokenizing US Treasuries onto the XRP Ledger is a significant development that could alter XRP’s market landscape. CryptoSensei highlights the vast size of the US Treasury market, which stands at over $28 trillion, suggesting a mere fraction transitioning to the XRPL could represent a radical increase in XRP’s valuation. The successful migration of traditional financial assets to blockchain systems reflects a broader acceptance of cryptocurrency as a valid alternative for asset management.

Moreover, if substantial amounts of capital flow through the XRP Ledger, it could catalyze further growth and spur additional use cases, potentially transforming XRP into a primary asset for real-world capital flows. This could lead to institutional investors viewing XRP as a long-term investment, subsequently driving its price upward as liquidity and demand increase across financial markets.

Derivatives Market Potential: A New Frontier for XRP

CryptoSensei discusses the burgeoning field of derivatives and how they could become a lucrative opportunity for XRP through tokenization. With derivatives markets valued in the hundreds of trillions, capturing even a fraction of this market would fuel significant demand for XRP as these assets move on-chain. By collaborating with platforms that are developing derivatives exchanges on the XRPL, Ripple is positioning itself strategically at the intersection of traditional finance and blockchain technology.

The influx of derivatives on the XRP Ledger could lead to the locking up of vast quantities of XRP for liquidity needs, thereby reducing circulating supply and potentially amplifying its price. The ability of XRP to manage large volumes in derivative trading would further enhance its liquidity profile, suggesting an impending bullish cycle as institutional adoption drives demand and subsequently supports a price surge.

CBDCs and XRP: Bridging the Future of Digital Finance

Finally, CryptoSensei emphasizes Ripple’s involvement with various central banks in exploring Central Bank Digital Currencies (CBDCs). There’s tremendous potential for XRP to act as a bridge currency between different digital currencies, facilitating smooth transactions across platforms. As more governments look to digitize their currencies, the demand for reliable and efficient settlement mechanisms will rise—placing XRP in a strategic position to capitalize on this trend.

CBDC pilots and collaborations not only increase the legitimacy of XRP but also enhance its usability as a universal liquidity tool. Such developments could potentially create a robust ecosystem where XRP plays a crucial role in the functioning of digital currencies worldwide. As these partnerships with central banks materialize, XRP’s price could react positively to heightened perceptions of its stability and utility in the global financial landscape.

Frequently Asked Questions

What are the latest XRP price predictions considering the ongoing legal case against Ripple?

The latest XRP price prediction suggests significant potential growth, especially if the ongoing legal case against Ripple resolves positively. Experts believe that once regulatory clarity is achieved, XRP could experience a price surge, possibly reaching the four- to five-digit range, driven by increased institutional adoption and participation from major banks.

How could regulatory clarity impact the XRP price forecast?

Regulatory clarity is vital for the XRP price forecast, as it could unlock broader institutional adoption. Many financial institutions are currently hesitant to engage with XRP without clear guidelines. If the SEC’s legal actions conclude favorably for Ripple, it could lead to a substantial XRP price increase as banks and other entities begin using XRP for transactions and tokenization.

What is the connection between XRP trading analysis and the potential price surge?

XRP trading analysis indicates that significant adoption of XRP for transactions and tokenizing real-world assets could lead to a crypto price surge. Analysts highlight that as more institutions express interest in utilizing XRP, the demand and trading volumes are likely to increase, positively impacting XRP’s market price.

What factors should investors consider in XRP price predictions?

Investors should consider various factors such as regulatory developments, the outcome of the Ripple legal case, institutional interest, and innovations related to tokenization on the XRP Ledger. These elements will collectively influence future XRP price predictions and overall market sentiment.

How does the potential for tokenizing real-world assets affect XRP’s market outlook?

The potential for tokenizing real-world assets on the XRP Ledger positively affects XRP’s market outlook by creating new use cases and driving demand. As major sectors like real estate and finance explore tokenization, XRP could play a crucial role, significantly increasing its adoption and price.

What implications does the SEC’s recent case drop have for XRP price predictions?

The SEC’s recent trend of dropping cases against other crypto firms could have positive implications for XRP price predictions. If Ripple experiences similar outcomes in its legal battles, it may lead to increased confidence and institutional investment in XRP, thereby pushing the price higher.

How does international collaboration impact XRP’s future price?

International collaborations involving Ripple, such as those with central banks and major payment networks, enhance XRP’s legitimacy and adoption potential. These partnerships could solidify XRP’s role in global finance, positively impacting its future price predictions.

What role do derivatives play in the XRP price forecast?

Derivatives represent a vast market that could significantly impact XRP’s price forecast. If XRP captures even a small share of the derivatives market, it would lead to increased demand and price appreciation, as traders and investors seek exposure to this asset.

What insights can be drawn from the current XRP trading analysis about future price movements?

Current XRP trading analysis indicates bullish sentiment among investors as regulatory clarity approaches. Analysts highlight potential catalysts, such as institutional adoption and technological advancements within the Ripple ecosystem, suggesting that XRP’s price may experience upward momentum in the near future.

Why is the legal situation between Ripple and the SEC crucial for XRP price predictions?

The legal situation between Ripple and the SEC is crucial for XRP price predictions because it directly affects market confidence and regulatory acceptance. A favorable resolution could pave the way for widespread adoption and drive XRP’s price to higher levels.

| Key Factor | Description |

|---|---|

| Regulatory Clarity For XRP | Importance of resolving ongoing SEC litigation for increased institutional adoption. |

| Institutions Standing By To Use XRP | Major financial institutions are ready to adopt XRP, pending regulatory clarity. |

| Potential SEC Case Drops | Trends of SEC dropping cases may favor Ripple’s legal position. |

| Tokenization Of Real-World Assets (RWAs) | XRP Ledger’s potential for real-world asset tokenization could lead to substantial market integration. |

| Interoperability Bridges | The development of cross-chain bridges enhances liquidity on the XRP Ledger. |

| Cross-Border Payment Solutions | XRP facilitates fast and cost-effective cross-border transactions, competing with traditional methods. |

| Collaborations With Key Global Institutions | Partnerships with top payment networks highlight Ripple’s influence in developing payment standards. |

| Treasury Market On XRP Ledger | Potential for US Treasuries and other bonds to migrate to XRP could drastically affect liquidity. |

| Derivatives Expansion | Expansion in derivatives markets could increase demand for XRP significantly. |

| Central Bank Digital Currencies (CBDCs) | Ripple’s work with central banks positions XRP as a key player in digital currency infrastructure. |

Summary

The XRP price prediction hinges on several pivotal factors, including regulatory clarity and institutional adoption. With a comprehensive strategy revolving around significant legal developments and the growing trend of tokenization, XRP is poised for substantial growth. If these conditions are met and Ripple successfully navigates its legal challenges, we could witness XRP approaching four- or even five-digit valuations in the future. As the cryptocurrency landscape evolves, the market is closely watching these catalysts to shape XRP’s potential.

As interest in cryptocurrency continues to grow, many investors are eager for an XRP price prediction that reflects the potential for significant gains. Recent analysis from experts, including the founder of the Cryptonairz community, suggests that XRP could ascend to impressive heights of four- or even five-digit valuations in the near future. This optimism is driven by various factors such as regulatory clarity concerning the ongoing legal case with the SEC and increasing adoption of XRP for institutional use. Key developments in the crypto market, combined with recent Ripple XRP news, support a bullish XRP forecast that could see the token recover from previous price declines. With the potential for a crypto price surge on the horizon, savvy traders are turning to XRP trading analysis to capitalize on these developments.

The current climate in the cryptocurrency world has many enthusiasts closely monitoring XRP and its trajectory. With Ripple at the forefront of legal battles and collaborations with major financial institutions, the sentiment surrounding XRP’s future remains largely optimistic. Market observers are particularly interested in how regulatory developments could clear the path for broader acceptance of XRP as a pivotal asset in the global finance landscape. Furthermore, the increasing trend of tokenizing real-world assets on platforms like the XRP Ledger suggests a transformative period for digital currencies. Investors and analysts alike are intrigued by the potential of XRP to emerge as a leader in cross-border payment solutions and digital asset innovation.