Solana price analysis reveals the cryptocurrency is at a critical juncture, trading near vital price levels that could dictate its immediate trajectory. Over recent weeks, selling pressure has dominated the market, leading to uncertain price movements, while bulls are making an effort to assert their influence and recapture higher resistance zones. A pivotal point in Solana’s performance is drawing attention from traders, as it could potentially set the stage for a trend reversal. Nonetheless, the broader context of the crypto market analysis, with macroeconomic factors at play, complicates the outlook. As investors sift through Solana trading trends and SOL price predictions, it’s crucial to monitor the stability of key resistance levels that will influence the asset’s future.

In examining Solana’s current situation, one could also refer to this analysis as a critical assessment of SOL’s market position amidst evolving conditions. With traders keenly observing the shifting dynamics, it becomes increasingly essential to understand the implications of resistance thresholds and support levels. Various metrics and indicators are being evaluated to gauge potential price movements, particularly as macroeconomic pressures and international trade disputes escalate. Analysts are particularly focused on discerning how these external factors may influence investor sentiment and ultimately impact Solana’s recovery potential. This discourse not only reflects an intricate web of market interactions but also suggests that a resurgence in buyer confidence could elevate Solana’s standing in the competitive crypto arena.

Solana Price Analysis: Key Resistance Levels to Watch

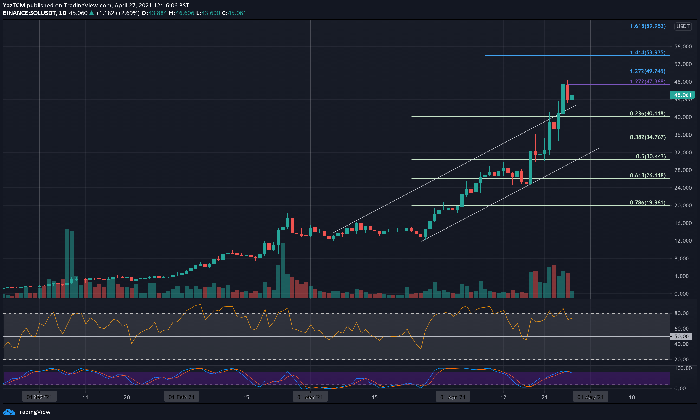

In this current Solana price analysis, the SOL cryptocurrency is experiencing significant trading activity around the $132 resistance level. Watchers of Solana must keep an eye on this price point, as a successful breakout above $135 could signal a shift in market momentum. Historically, the $150 area has tested many bullish attempts, serving as a critical barrier to higher gains. If bulls can manage a decisive close above this resistance, Solana may establish an upward trajectory, suggesting a potential rally and renewed investor confidence in the cryptocurrency’s future.

Conversely, Solana’s inability to hold above these resistance levels may lead to further price declines. Should SOL fail to defend the $125 support level, traders could witness a worrying drop towards the $100 mark, raising concerns about the overall health of the altcoin market. The macroeconomic factors influencing crypto, such as inflation and international trade tensions, exacerbate these risks. Coin market participants need to conduct thorough analysis and remain attentive to the trading trends surrounding Solana as the volatility in the crypto landscape persists.

Understanding Solana Trading Trends Amidst Market Volatility

Currently, the trading trends surrounding Solana reflect a crucial juncture in its price movement. Observers note that the price fluctuation of SOL aligns closely with broader crypto market analysis, where macroeconomic factors play a significant role in shaping sentiment. The intensified trade disputes between the United States and China have created an environment marked by uncertainty, heavily impacting bulls’ capability to assert control over rising price levels. As a result, Solana’s trading activity has become increasingly reactive, mirroring the sentiments prevalent across the crypto landscape.

Investors and traders alike are now focused on how Solana’s trajectory will unfold in response to external pressures. On the technical front, traders must analyze SOL’s trading volume and price indicators, as these elements are indicative of potential bullish reversals or continued downtrends. The alignment of Solana’s trading patterns with macroeconomic occurrences, alongside the pressure from global markets, suggests that SOL enthusiasts should employ a strategy that accommodates both short-term volatility and long-term growth potential.

SOL Price Prediction: Analyzing Future Trends and Support Levels

As we dive into SOL price predictions, market analysts are assessing Solana’s potential to recover from recent declines. Given its significant drop since reaching an all-time high in January, the $132–$135 range appears to be a battleground for bulls. If Solana can secure this area, analysts believe it may signal the beginning of a recovery phase. With a strong focus on reclaiming the $150 threshold next, a successful breach of this resistance would likely invite bullish confidence and may initiate a new trend upwards.

However, SOL price predictions also highlight the necessity of caution, particularly with macroeconomic conditions remaining uncertain. Factors such as rising inflation and geopolitical tensions continue to loom large over the cryptocurrency market. Analysts caution that unless Solana can exhibit strength in reclaiming and holding critical support levels, such as $125, the risk of further declines remains considerable. Keeping abreast of key resistance levels will be vital as traders navigate this complex environment.

The Macro Economic Impact on Crypto: Solana at the Forefront

The ongoing trade tensions and economic instability have led to increased complexities in the crypto market, with Solana being no exception. As risk assets, including altcoins like SOL, are often hit harder during periods of uncertainty, traders are observing closely how Solana responds to evolving macroeconomic scenarios. The latest tariffs imposed on imports between the U.S. and China present a turbulent backdrop against which Solana’s price movements will be analyzed as investors strategize amidst these external pressures.

Moreover, the impact of macroeconomic fluctuations encourages many traders to consider how Solana’s tech fundamentals stand against the volatility in the marketplace. While some analysts exhibit optimism based on technical indicators suggesting a potential bullish reversal, the prevailing global economic climate could alter these dynamics significantly. As such, understanding the macroeconomic factors at play remains crucial for anyone involved in Solana trading trends, as they could determine the crypto’s direction in the forthcoming weeks.

Navigating Solana’s Resistance Levels: Insights for Traders

Navigating the resistance levels in Solana trading is key for traders looking to capitalize on potential price movements. As SOL currently hovers around the $132 mark, efficient trade strategy execution will hinge on recognizing these pivotal resistance zones. Analysts are urging traders to stay vigilant for signs of bullish momentum that could emerge if the $135 level is breached, as this could potentially usher in the commencement of a recovery rally, reversing the downward trend seen in recent months.

Furthermore, consistent observations of trading trends related to Solana could reveal whether or not it can successfully defend crucial support levels. This critical battleground scenario plays a significant role in determining whether bulls have the upper hand or if bearish forces will resume control. As the volatility of the cryptocurrency market continues, traders must adapt accordingly and use robust technical analysis to inform their positions in response to Solana’s intricate price movements.

Short-term Outlook for Solana: Bullish or Bearish?

With the volatility in the crypto market, many are questioning the short-term outlook for Solana: will the momentum turn bullish or bearish? Recent price action suggests that while Solana faces challenges reclaiming essential resistance levels, there are sparks of optimism with some analysts forecasting a potential bullish reversal. If SOL can rally above $135, it would signal a potential change in sentiment, opening the door for upward price targets and possibly inviting new investors to the fray.

On the flip side, traders must remain adaptable since the broader economic landscape could influence Solana’s performance substantially. With concerns regarding inflation and international trade affecting crypto assets profoundly, SOL’s trajectory may follow cues from the global market sentiment. As traders assess their positions, implementing risk management strategies becomes imperative to navigate this uncertain short-term outlook effectively.

Understanding Crypto Market Analysis: Solana’s Position

Understanding crypto market analysis is essential for grasping Solana’s standing in today’s digital landscape. As multiple factors influence the price dynamics of SOL, market analysts emphasize the importance of tracking various trading metrics. The correlations between Solana’s trading patterns and movements in broader cryptocurrencies provide valuable insights into potential future price actions. By tapping into these analytical frameworks, traders can make informed decisions about their investments in Solana.

Furthermore, Solana’s position in the crypto market is often reflective of the overall sentiment toward altcoins. As market momentum sways with external macroeconomic impacts, incorporating systematic approaches from crypto market analysis will allow traders to identify viable trading setups. As Solana continues to navigate through these turbulent financial currents, enhanced analytical perspectives can elucidate potential opportunities that may arise amid the chaos.

Sustainable Growth for Solana: Challenges Ahead

For SEO-optimized content, discussions around sustainable growth for Solana highlight the hurdles faced amid macroeconomic uncertainties. As SOL seeks recovery, the path forward will not only depend on reclaiming lost resistance levels but also on broader market sentiments reacting to economic indicators. The challenges presented by inflation and trade wars necessitate strategic planning and foresight for ongoing recovery efforts.

Addressing these challenges will require collaborative approaches from the community and investors alike. Solana must demonstrate resilience against external pressures while solidifying its technological foundations. Working through these challenges gracefully will be paramount for Solana to pursue sustainable growth and regain its standing within the competitive cryptocurrency market.

Frequently Asked Questions

What is the current market trend for Solana price analysis?

The current market trend for Solana price analysis indicates that SOL is at a critical juncture. After experiencing significant selling pressure, bulls are attempting to regain control. A recovery rally will depend on reclaiming key resistance levels, specifically around $132 to $135, which are crucial for establishing a bullish momentum.

How do macroeconomic factors impact Solana’s price analysis?

Macroeconomic factors, such as the ongoing trade tensions between the U.S. and China and rising inflation, have created a volatile environment for cryptocurrencies, including Solana. These tensions contribute to investor uncertainty, impacting Solana price analysis as the asset remains vulnerable to broader market corrections. Traders are cautious as they navigate these conditions.

What are the key support and resistance levels in Solana price analysis?

In Solana price analysis, key support is identified at $125, while significant resistance exists around the $150 level. A breakout above this resistance could signal a trend change and potential recovery for SOL, whereas failure to hold above the support could lead to further declines.

What are the latest SOL price predictions based on technical analysis?

Recent SOL price predictions based on technical analysis suggest that if Solana can break above the $147 level, it may confirm a bullish trend shift. However, it must hold above the $132 to $135 range to avoid deeper corrections and maintain upward momentum.

How significant are Solana trading trends in the context of the overall crypto market?

Solana trading trends are significant in the context of the overall crypto market as they reflect broader market sentiments and investor behaviors. With macroeconomic pressures influencing investor confidence, Solana’s price dynamics offer vital insights into potential movements within the altcoin space, especially as it seeks to reclaim higher price levels amidst volatility.

| Key Points |

|---|

| Solana is at a critical price level that affects its short-term direction. |

| Bulls are trying to regain control, but need to break higher resistance zones. |

| Macro tensions, including US-China trade disputes, create a high-risk environment. |

| Solana has lost 55% of its value since its all-time high in January. |

| Key resistance at $132–$135 must be reclaimed for a recovery rally. |

| If successful, a breakout above $150 could signal further bullish momentum. |

| Falling below $125 could lead to a significant price drop. |

| Traders are monitoring the $135 level closely for signs of recovery. |

Summary

Solana price analysis reveals that the cryptocurrency is currently navigating a pivotal point, with its future direction heavily dependent on overcoming critical resistance levels. Following significant losses over recent months, the market sentiment remains cautious due to macroeconomic pressures. As Solana attempts to regain momentum, traders are focused on key price zones, indicating that the upcoming movements will be crucial for establishing a recovery path. The interplay between market conditions and technical indicators will be vital for determining whether bulls can reclaim control.

Solana price analysis is currently crucial as the cryptocurrency finds itself at a pivotal point in its trading journey. Observers are keenly examining the latest Solana trading trends, especially as bulls make a concerted effort to reclaim significant resistance levels that could dictate future price movements. With the broader crypto market analysis reflecting heightened volatility, understanding SOL’s price prediction has never been more vital. As macroeconomic factors cast uncertainty over the market, Solana demonstrates both potential and peril, making thorough analysis essential for traders. This critical juncture presents a unique opportunity for investors looking to navigate the complexities of Solana’s recent price fluctuations.

In today’s dynamic digital currency landscape, Solana is capturing the attention of investors and analysts alike, especially when exploring its recent trading behaviors. Evaluating the performance of SOL can reveal intriguing insights about potential future movements and help traders navigate around critical price thresholds. As market analysts delve into Solana’s resilience amid prevailing economic pressures and external market influences, it becomes evident that understanding its resistance levels is paramount. With a keen eye on macroeconomic events, participants in the crypto space are eager for clear indications that might signal either a bullish resurgence or the continuation of downward trends. Alternative perspectives on Solana’s market position underscore the importance of strategic analysis amidst shifting crypto realities.