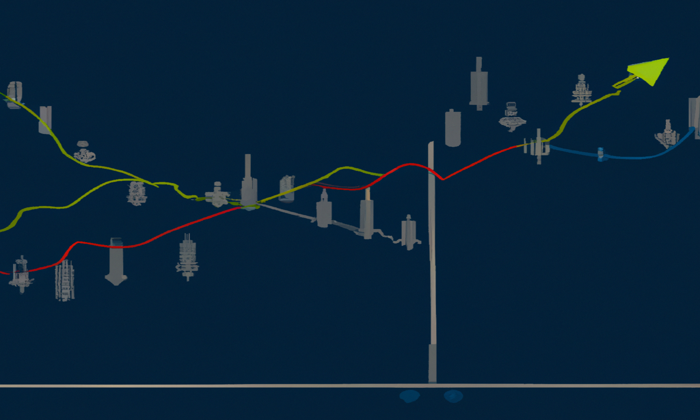

Solana price action has recently entered a critical phase, as traders closely monitor its struggle to reclaim the pivotal point of control within its trading range. This rejection at the key volume level signals a bearish compression, causing a ripple effect that has left the cryptocurrency poised for potential movement below the psychologically significant $90 mark. A liquidity sweep in this area is on the horizon, which could either create a swing failure pattern or prompt a bullish reversal, injecting new life into Solana’s prospects. Traders and analysts alike are scrutinizing SOL chart patterns to gauge market sentiment and identify potential turning points. As Solana navigates these challenges, effective Solana trading analysis will be vital for investors looking to capitalize on the ever-evolving dynamics at play in the market.

In recent weeks, the fluctuations in Solana’s market value have captured the attention of cryptocurrency enthusiasts. The ongoing challenges faced by SOL, particularly in reclaiming crucial support levels, reveal a delicate balance between bullish aspirations and bearish pressures. Observers are assessing the possibility of a liquidity grab in the vicinity of $90, a threshold that many believe could trigger a significant shift in momentum. The role of the point of control, which highlights where most market activity has taken place, becomes paramount as traders analyze the implications of these movements. Understanding the nuances of Solana’s trading environment, including liquidity sweeps and reversal patterns, will be essential for anyone looking to navigate these turbulent waters effectively.

Understanding Solana Price Action and Market Trends

When analyzing Solana’s price action, it’s critical to understand the broader market trends and the underlying forces driving the movements. Currently, Solana is facing challenges as it attempts to reclaim its critical point of control within a defined trading range. This inability to maintain above the point has introduced bearish sentiments, suggesting that traders should remain vigilant as the potential for a dip beneath key psychological levels like $90 may materialize. The pressure created from the rejection at this point highlights the importance of liquidity events, which can drastically shift market dynamics and investor confidence.

Furthermore, understanding the market psychology behind Solana’s trading patterns is essential for accurate assessments. Price action is often influenced not just by current valuations but by the historical price levels that serve as reference points for traders. The ongoing battle around the point of control indicates that liquidity sweeps could trigger a series of sell-offs, bringing the price closer to that crucial $89 support level. As the market continues to compress around this area, traders should look to chart patterns and other technical indicators to guide their trading strategies.

The Importance of the Point of Control in Solana Trading Analysis

The point of control (POC) represents the price level where the highest volume of trading occurred, making it a pivotal area for any trader focused on Solana. Currently, this level has transitioned from support to resistance, reflecting the challenges the asset faces as it seeks to stabilize. When prices fail to reclaim the POC convincingly, it signals to traders that the bullish momentum has waned, necessitating a cautious approach. Detailed examination of SOL chart patterns can provide insights into price movements around defined volume nodes, enhancing trading strategies in this volatile market.

The retention of the point of control as a resistance level demonstrates the dynamics of supply and demand, causing significant reactions to trades that occur near this threshold. If Solana successfully breaks back above this critical point, it could spur a bullish reversal, elevating sentiment and attracting buying pressure. In contrast, failing to hold above may lead to a liquidity sweep below $90, compelling traders to adapt quickly. Utilizing tools such as support and resistance identification alongside volume analysis is essential for making informed decisions in this evolving market.

Exploring Liquidity Sweep Strategies for Solana

Liquidity sweeps are a prominent feature in the trading ecosystem of Solana, especially around critical levels such as $90. The concept refers to the market’s propensity to target liquidity pools filled with stop orders, which can lead to rapid price movements. As traders holding positions in the $100 to $130 range face the threat of a liquidity sweep, it becomes apparent that the area beneath $90 could be highly susceptible to volatility. Increased trading volume in this zone may trigger aggressive price action that could either clear out stops or lead to a quick reversal if counteractive force emerges.

Implementing a strategy that anticipates a liquidity sweep requires careful monitoring of market conditions and trader sentiment. By observing order flow and market depth, traders can better gauge when to engage with potential reversals. For Solana, maintaining awareness of surrounding price levels and being prepared for rapid shifts in sentiment can be the difference between capturing profit or incurring loss. Hence, the focus on liquidity dynamics paired with solid risk management techniques ensures traders can navigate the complexities surrounding this asset effectively.

Bullish Reversal Patterns in Solana’s Price Dynamics

Bullish reversal patterns play a crucial role in determining the next directional move for Solana after a bearish phase. Traders often look for specific indicators that signify a potential shift, especially after the asset has experienced rejection at significant resistance points. If the price manages to achieve a swing low near the $89 mark and forms a solid swing failure pattern (SFP), it may trigger buying interest that could rally prices upwards. Monitoring these reversal patterns not only aids in identifying timing for entries but also assists in validating breakout movements.

Moreover, the formulation of bullish reversal signals relies heavily on the interaction with previous support and resistance levels. If Solana can reclaim the pivotal point of control post-reversal, it will bolster confidence among traders about potential upward shifts towards higher targets, such as $178-$252. In this scenario, maintaining tight stop losses around entry points while capitalizing on glaring bullish signals will create opportunities to ride the anticipated market momentum effectively.

Implications of Market Sentiment on Solana Price Action

Market sentiment is a powerful driver of price action for Solana as traders assess impacts from technical analysis, external news, and broader market trends. Currently, the prevailing sentiment towards Solana is cautious, particularly in light of its inability to reclaim the key point of control. A bearish outlook stemming from poor rejection levels can prompt traders to liquidate positions, contributing to downward pressure and creating fear in the market. Thus, sentiment analysis becomes an essential tool for traders to predict potential price movement and prepare for ensuing volatility.

As market conditions evolve, sentiment can shift dramatically, especially if critical resistance levels are broken or liquidity sweeps occur. Positive developments around Solana or broader crypto trends might invigorate bullish sentiment, compelling traders to initiate long positions. This interplay between sentiment and technical setups accentuates the need for a comprehensive approach that includes understanding underlying market dynamics, leveraging sentiment indicators, and remaining adaptable to shifts in the trading landscape.

Technical Analysis of SOL Chart Patterns for Better Trading

Engaging in technical analysis of Solana’s chart patterns is paramount for any trader looking to optimize their strategy in a volatile market. By analyzing SOL’s movements over various time frames, traders can identify significant trends, potential reversal points, and breakout opportunities. Key patterns such as head and shoulders, double tops, or bottoms provide valuable insights into market psychology, informing traders about possible shifts in momentum. Utilizing these patterns helps in enhancing predictions about price actions, especially during pivotal moments like potential liquidity sweeps.

The integration of trend lines, moving averages, and volume analysis into the technical toolkit can significantly refine a trader’s assessment of Solana’s chart patterns. A consolidated view helps to identify optimal entry and exit points while managing risk effectively. With the current sentiment leaning unstable, being adept at interpreting chart patterns will guide traders in making informed decisions, potentially exploiting opportunities for profit amidst market fluctuations.

Navigating Short-term and Long-term Trends in Solana Trading

Navigating between short-term and long-term trends is essential for traders engaged in Solana markets. In the short term, the focus may revolve around reclaiming points of control and analyzing immediate support levels, like $89, to assess potential entries. The volatility characterizing short-term trading can translate into rapid gains or losses; hence, understanding market momentum is critical. Traders should stay alert to any shifts in sentiments, particularly as Solana approaches pivotal liquidity zones that could dictate the direction of price action.

On the other hand, considering long-term trends involves evaluating broader market cycles and historical performances of Solana. Understanding how long-term liquidity levels align with key support and resistance areas provides context for investment decisions. Traders often seek the resilience of price structures and patterns indicating bullish or bearish dynamics that may unfold over months or years. Balancing short-term tactical trading with an eye on longer-term trends ensures a comprehensive approach to capitalizing on Solana’s market potential.

Risk Management Strategies for Solana Traders

Effective risk management is an indispensable element of trading successfully in the volatile world of Solana. Traders must recognize the inherent risks presented by liquidity sweeps and volatile market conditions that can result in unpredictable price movements. Establishing clear risk levels with well-defined entry and exit strategies is essential in mitigating potential losses, especially when trading around vulnerable areas such as the $89 support. Trailing stop losses and position sizing techniques can provide a buffer against unforeseen market swings.

Furthermore, cultivating a disciplined trading mindset is crucial in navigating the intricacies of Solana’s price action. Establishing rules about when to exit losing trades or take profits can maintain psychological fortitude amidst market fluctuations. Educated traders who combine technical analysis with sound risk management strategies are better positioned to capitalize on potential reversals or bullish trends, ultimately enhancing their chances of long-term success.

The Future of Solana: Price Projections and Market Outlook

As traders assess the future of Solana, price projections will be influenced by the ongoing market dynamics and external economic factors. Analysts often consider historical performance alongside current technical indicators to forecast potential pricing trends. Should Solana successfully reclaim its point of control and circumvent current resistance, analysts suggest that price levels between $178 to $252 become feasible targets in the near term. This upward trajectory depends significantly on not just reclaiming lost ground but also establishing a robust market sentiment that encourages long positions.

Moreover, Solana’s future hinges on technological advancements and broader crypto market adoption. Success in building user-friendly applications and enhancing the blockchain’s scalability will play a role in sustaining bullish sentiment among traders. Understanding that these developmental factors significantly intertwine with Solana’s price action enables traders to align their strategies accordingly, ensuring they are not only reactive to immediate market conditions but also proactive in positioning themselves for future trends.

Frequently Asked Questions

What does the recent Solana price action indicate about future trends?

The recent Solana price action suggests that the cryptocurrency is struggling to reclaim its key point of control, indicating a potential bearish outlook unless this resistance is overcome. Traders are advised to monitor bullish reversal signals, especially around key support levels.

How does the liquidity sweep below $90 affect Solana trading analysis?

The liquidity sweep below $90 could trigger a significant move in Solana, as it may lead to a swing failure pattern that sets the foundation for a bullish reversal. This area is crucial for traders looking to capitalize on price movements in Solana.

Why is the point of control important in Solana chart patterns?

The point of control is critical in Solana chart patterns because it represents a significant volume zone where trading activity is concentrated. A failure to reclaim this point can lead to bearish compression, while a successful breach could shift the momentum towards bullish trends.

What is a swing failure pattern (SFP) in the context of Solana price action?

A swing failure pattern (SFP) in Solana price action occurs when the price drops below a key support level, such as $89, only to quickly recover, suggesting a potential bullish reversal. This pattern can indicate market manipulation targeting liquidity.

How can traders anticipate bullish reversals in Solana trading?

Traders can anticipate bullish reversals in Solana trading by looking for signs of a swing failure pattern near key support zones, particularly around $89. Additionally, reclaiming the point of control can signal a shift in momentum towards higher price targets.

What are the implications of Solana’s rejection at the point of control?

The implications of Solana’s rejection at the point of control include heightened bearish pressures, as this level has transitioned from support to resistance. Until Solana decisively reclaims this area, the risk of further downside increases, necessitating caution among traders.

How should Solana traders react to current market conditions?

Solana traders should closely observe price action around the $89 support level for potential liquidity sweeps and consider entering long positions upon signs of a swing failure pattern. Conversely, if the price fails to reclaim the point of control, protective measures may be necessary.

| Key Points |

|---|

| Solana is struggling to reclaim its key point of control, leading to bearish pressure. |

| $89 support is crucial for a potential swing failure pattern and reversal trigger. |

| Liquidity below $90 could lead to a bullish rotation back towards $178–$252. |

| Rejection at the volume point of control has turned it into resistance, increasing the possibility of a decline. |

| Market behavior typically hunts for liquidity, making the region below $90 significant for price action. |

| To trade this setup, look for signs of a swing failure pattern near $89 for long entries. |

Summary

Solana price action is currently under significant pressure as it struggles to reclaim the critical point of control, with bearish signs prevailing. The area around $89 remains a pivotal support point that traders are watching closely for potential reversal signals. With the prospect of liquidity grabs below this threshold, traders need to remain cautious while looking for opportunities. If Solana is able to stabilize and regain this key level, the outlook may shift positively, indicating a potential surge towards higher resistance levels.

Solana price action has been the focus of traders as it experiences turbulent movements around a crucial point of control. The current trading environment indicates a struggle for the cryptocurrency to reclaim this key resistance level, complicating its short-term outlook. As the SOL price hovers below $90, it raises significant concerns over a potential liquidity sweep that could lead to further downward pressure. Analysis of SOL chart patterns reveals bearish compression, leaving traders on high alert for a bullish reversal. With liquidity positioned just below that psychological threshold, the coming days could be pivotal for Solana’s next price direction.

Examining Solana’s recent trading behavior, we find that the cryptocurrency is caught in a challenging situation where it must regain control of significant volume levels. This current market dynamic reflects a critical test as bullish momentum seems stifled, creating a landscape where volatility is heightened. The presence of liquidity beneath the $90 mark signals the potential for significant price movements, compelling traders to remain vigilant. A swing failure may emerge if Solana’s price dips below this critical support area, opening pathways to possible reversals or haunt shifts in sentiment. Overall, understanding these dynamics is essential for anyone looking to navigate this complex trading environment.

Leave a Reply