LayerZero is rapidly emerging as a transformative force in the blockchain space, enabling seamless cross-chain communication among 125 networks. This innovative protocol has recently garnered attention following a substantial investment from Andreessen Horowitz’s crypto arm, which acquired an additional $55 million in LayerZero tokens (ZRO). With this backing, LayerZero’s investment appeal continues to grow, driven by its pivotal role in blockchain interoperability and a vibrant ecosystem supporting projects like Wyoming’s stablecoin. As the demand for effective cross-chain solutions rises, the ZRO cryptocurrency has seen an impressive uptick in value, highlighting the potential of LayerZero’s technology. In a world increasingly converging toward decentralized finance, LayerZero stands at the forefront of this movement, making it a key player to watch in the evolving landscape of digital assets.

The innovative platform known as LayerZero represents a significant leap in blockchain technology, focusing on enhancing connectivity across various chains. Recently, it hit the spotlight as the ZRO token experienced a notable price surge, thanks to fresh investments from notable venture capital firms like a16z. This protocol facilitates frictionless communication between isolated blockchains, ensuring efficient data exchange and transaction management, crucial for the flourishing world of decentralized finance. By unlocking blockchain interoperability, LayerZero not only supports the infrastructure of significant projects but also promises to revolutionize how assets are handled across different networks. As we dive deeper into the implications of this technology, understanding the potential of the ZRO cryptocurrency and its evolving role in cross-chain ecosystems becomes increasingly vital.

Introduction to LayerZero: Pioneering Blockchain Interoperability

LayerZero is revolutionizing the blockchain landscape by providing a robust interoperability framework that facilitates seamless communication across disparate blockchains. Co-founded by Ryan Zarick and Bryan Pellegrino, LayerZero’s protocol enables the transfer of data and assets across 125 different blockchains, making it a vital player in the evolving world of decentralized finance (DeFi) and beyond. Its functionality is not only beneficial for developers looking to create cross-chain applications but also supports the broader ecosystem by enhancing overall blockchain efficiency and user experience.

The protocol’s ability to facilitate over 145 million cross-chain messages and support transactions worth $75 billion highlights its significance in bridging the gaps between isolated networks. In recent developments, LayerZero’s importance has grown, particularly with major investments from venture capital firms like Andreessen Horowitz, which reinforces the project’s potential and viability as a leading solution in blockchain interoperability.

Understanding ZRO Cryptocurrency and Its Significance

The native token of LayerZero, known as ZRO, has captured the attention of investors and users alike as it plays a crucial role in the protocol’s ecosystem. Following a significant investment announcement from Andreessen Horowitz, the ZRO cryptocurrency experienced a notable price surge, indicating strong market interest and confidence in LayerZero’s long-term success. At its peak, ZRO had advanced by approximately 10%, showcasing its performance in comparison to other digital assets like Bitcoin.

With the backing of established investors and a firm operational strategy, LayerZero’s ecosystem promises to grow exponentially. The intuitive architecture of LayerZero not only streamlines blockchain interactions but also fosters an environment where ZRO token holders can leverage their investments through enhanced functionality, such as governance and transaction fee reductions across multiple networks.

The Role of LayerZero in Cross-Chain Communication

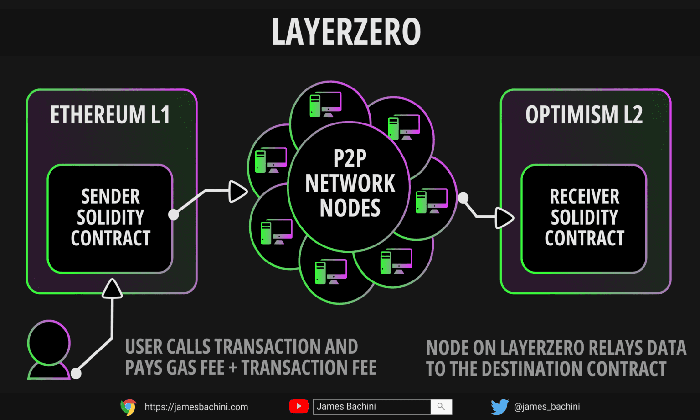

LayerZero serves as a pivotal infrastructural layer that allows for efficient cross-chain communication, a fundamental feature that modern blockchain networks desperately need. By enabling isolated blockchains to interact, LayerZero creates an interconnected ecosystem that enhances collaboration between various projects and platforms. This integration is an essential step towards achieving true decentralization where assets and data can flow freely across different blockchain environments.

As more projects adopt LayerZero’s protocol, users benefit from a broader range of services and applications that leverage cross-chain capabilities. This synergy not only optimizes transaction experiences but also reduces costs and increases the overall transaction speed. As LayerZero continues to expand its reach, the implications for the cryptocurrency market and DeFi are profound, allowing for more sophisticated financial products to emerge.

Investing in LayerZero: Opportunities and Outlook

Investors are increasingly recognizing LayerZero as a promising investment opportunity, especially with recent funding rounds that have established a solid financial foundation. The commitment from Andreessen Horowitz and previous investments highlight the confidence in LayerZero’s ability to maintain its growth trajectory. For potential investors, understanding the implications of ZRO’s price movements and the protocol’s technological advancements will be key to navigating opportunities in the cryptocurrency space.

The long-term outlook for LayerZero appears optimistic, especially with ongoing developments aimed at enhancing interoperability and introducing new features such as token issuance and governance mechanisms. As LayerZero continues to innovate and adapt within the rapidly evolving blockchain landscape, savvy investors could see substantial returns if they partake in the burgeoning growth of this pivotal protocol.

Exploring Blockchain Interoperability through LayerZero

Blockchain interoperability is gaining traction as a critical feature for the future of decentralized applications. LayerZero stands at the forefront of this movement, providing a secure and efficient means for different blockchain networks to communicate and transact with each other. This capability not only enhances the utility of individual blockchain projects but also creates a cohesive environment where decentralized finance can thrive.

The expansion of LayerZero’s interoperability protocol supports various innovative projects, including PayPal’s stablecoin and other DeFi protocols. By enabling these systems to operate across multiple blockchains, LayerZero effectively reduces constraints traditionally imposed by isolated networks, paving the way for a more inclusive digital economy.

LayerZero’s Investment Backing and Market Response

The backing of prominent investors like Andreessen Horowitz has had a significant positive impact on LayerZero and its token ZRO. Following the announcement of an additional $55 million investment by a16z, market sentiment towards LayerZero shifted positively, leading to a surge in ZRO’s price. This trend reflects the greater confidence that institutional investors hold in LayerZero’s potential to influence the future of blockchain technology.

Investor confidence is further buoyed by LayerZero’s proven track record in facilitating cross-chain communication and processing high transaction volumes. As the market moves towards greater adoption of decentralized solutions, the stakes for LayerZero will continue to rise, making it an intriguing opportunity for those looking to invest in the future of blockchain technology.

How LayerZero Enhances DeFi Ecosystems

LayerZero’s innovative protocol does not just serve as a communication layer for blockchains; it also plays a crucial role in enhancing decentralized finance (DeFi) ecosystems by enabling seamless cross-chain asset transfers. Its design allows users to interact with multiple DeFi protocols across different chains without compromising security or user experience, thus fostering greater participation in the broader DeFi market.

Projects built on LayerZero can utilize its cross-chain capabilities to provide liquidity pools, yield farming opportunities, and diverse financial products that span various blockchains. This interoperability effectively broadens the scope of what is achievable within DeFi, making LayerZero a foundational technology that propels the industry’s growth.

The Future of Token Issuance with LayerZero

As blockchain technology progresses, the ability to issue tokens across multiple networks will become increasingly invaluable. LayerZero is positioned uniquely to take advantage of this trend due to its cross-chain functionalities. With its recent investments, LayerZero is looking to expand its offerings to include token issuance capabilities, allowing projects to launch on LayerZero’s protocol with the ease of cross-chain communication.

This advancement could change how new tokens are introduced to the market, potentially increasing their adoption and liquidity. Projects using LayerZero for token issuance can attract a wider audience by facilitating transactions and interactions with users across various blockchain networks, thereby enhancing their overall market presence.

LayerZero’s Impact on Regulatory Compliance and Governance

As blockchain technology and decentralized finance evolve, the need for regulatory compliance grows more pressing. LayerZero’s protocol supports governance mechanisms that allow projects to implement compliance measures effectively when facilitating cross-chain transactions. By providing the infrastructure for such governance models, LayerZero helps projects navigate the complex landscape of regulation while fostering innovation.

The governance features embedded in LayerZero’s design can enable token holders to influence decisions related to network upgrades, compliance measures, and operational guidelines. This democratic approach not only ensures that the community remains engaged but also aligns the protocol’s growth with regulatory expectations, ultimately contributing to a sustainable and compliant ecosystem.

Navigating Challenges in Blockchain Interoperability: LayerZero’s Approach

Despite the clear advantages of blockchain interoperability, challenges such as security risks and scalability concerns remain prevalent. LayerZero addresses these challenges by implementing state-of-the-art security protocols that safeguard cross-chain transactions. This focus on security ensures that users can trust LayerZero’s platform for their transactions, paving the way for broader adoption.

LayerZero’s commitment to scalability is equally notable; the protocol manages to handle high volumes of cross-chain messages without sacrificing performance. By combining security measures with innovative technology, LayerZero sets a standard for how interoperability across blockchains should be achieved, positioning itself as a leader in the space.

Frequently Asked Questions

What is LayerZero and how does it enhance blockchain interoperability?

LayerZero is a protocol designed to enable seamless cross-chain communication among isolated blockchains. By facilitating over 145 million messages across 125 blockchains, LayerZero significantly enhances blockchain interoperability, allowing for efficient data and value transfer.

How has the LayerZero token (ZRO) performed recently?

Recently, the LayerZero token (ZRO) surged in price by 10% to $2.56 following Andreessen Horowitz’s (a16z) investment of $55 million in ZRO tokens, committing to a 3-year lock-up period. Despite some retracements, ZRO has shown promising performance in the market.

What impact does Andreessen Horowitz’s investment have on LayerZero?

Andreessen Horowitz’s investment not only boosts the credibility of LayerZero but also provides essential funding for its expansion. The $55 million injection is intended to enhance LayerZero’s capabilities, allowing for advancements in token issuance, governance, and data management.

What are the potential uses of LayerZero’s cross-chain communication technology?

LayerZero’s cross-chain communication technology has various applications, including supporting stablecoin projects like PayPal’s and enabling innovative decentralized finance (DeFi) protocols. It allows different blockchains to interact, facilitating smoother transactions and value transfers.

Is investing in LayerZero (ZRO) a good opportunity?

Investing in LayerZero (ZRO) could be seen as a promising opportunity due to its unique role in enhancing blockchain interoperability and its recent backing by major investors like a16z. However, as with any investment, it is crucial to conduct thorough research and consider market conditions.

How does LayerZero support stablecoin issuance projects?

LayerZero supports stablecoin issuance projects by providing the necessary infrastructure for cross-chain communication. This capability is essential for projects like Wyoming’s stablecoin, enabling them to operate effectively across multiple blockchain networks.

What is the significance of LayerZero reaching $75 billion in value transfers?

LayerZero facilitating $75 billion in value transfers showcases its robustness and reliability as a cross-chain communication protocol. This figure reflects the trust and utility of LayerZero in the growing blockchain ecosystem, solidifying its position as a leader in blockchain interoperability.

What are the future developments expected for LayerZero?

Future developments for LayerZero include expanding its core functionalities beyond interoperability into areas like token issuance, enhanced governance, and sophisticated data management systems. These advancements aim to solidify LayerZero’s place in the evolving blockchain landscape.

| Key Points |

|---|

| LayerZero Co-founders: Ryan Zarick (CTO) and Bryan Pellegrino (CEO) |

| Recent investment: Andreessen Horowitz (A16z) acquired $55 million in ZRO tokens with a 3-year lock-up. |

| LayerZero’s token (ZRO) increased by 10% to $2.56 following the investment news. |

| The protocol enables cross-chain communication for 125 blockchains and has facilitated over 145 million cross-chain messages. |

| LayerZero has been involved with projects like PayPal’s stablecoin and Wyoming’s stablecoin issuance. |

| The investment is expected to help LayerZero expand capabilities in token issuance, data management, governance, and databases. |

Summary

LayerZero is rapidly establishing itself as a vital player in the blockchain interoperability space. With growing support from major investors like Andreessen Horowitz, its capabilities are set to enhance significantly. By enabling seamless communication across 125 blockchains, LayerZero not only facilitates diverse blockchain interactions but also positions itself at the forefront of evolving digital asset management trends. As the landscape for decentralized finance and stablecoins expands, LayerZero’s ongoing developments will likely play a critical role in shaping the future of blockchain communications.

LayerZero is at the forefront of blockchain technology, revolutionizing the way different networks communicate with each other. Recently, the LayerZero token (ZRO) experienced a significant spike in value after Andreessen Horowitz, known as a16z, invested an additional $55 million in ZRO tokens for a three-year lock-up period. This growing interest in LayerZero underscores the importance of cross-chain communication, setting the stage for improved blockchain interoperability across 125 supported chains. With its ability to facilitate over 145 million cross-chain messages and support $75 billion in transfers, LayerZero is becoming an essential player in the decentralized finance (DeFi) sector. As potential investors eye the possibilities of LayerZero investment, the technology’s robust capabilities promise to pave the way for a more connected crypto ecosystem.

In the evolving landscape of digital currencies, LayerZero stands out as a groundbreaking protocol designed to enhance communication between disparate blockchains. By leveraging its native asset, ZRO cryptocurrency, LayerZero aims to simplify cross-chain operations, allowing various decentralized applications to function seamlessly across multiple networks. The latest infusion of capital from a16z not only reinforces confidence in LayerZero’s innovative approach but also accelerates its mission of improving blockchain interoperability. With projects like stablecoin initiatives and decentralized finance platforms relying on its infrastructure, LayerZero presents an attractive opportunity for those looking to explore the future of blockchain technology and investment.