In the dynamic landscape of cryptocurrency, Chainlink price analysis reveals an intriguing narrative of potential recovery amidst ongoing bearish trends. Despite a notable downturn since reaching a local peak of $29.28 in December, analysts believe a bullish reversal may be on the horizon for LINK. With the current price hovering around $12.91, insights into the Chainlink market trend indicate that a crucial trendline support is pivotal for forthcoming price movements. As crypto market analysis unfolds, many investors are eyeing the LINK price forecast, which suggests that a resurgence could occur if buying pressure intensifies near the $12.00 mark. This technical outlook presents a fascinating opportunity for traders eager to capitalize on the altcoin’s potential rebound and navigate the volatile crypto market.

Examining the market dynamics surrounding Chainlink, various alternative terms such as LINK price trends and Chainlink’s performance metrics emerge as vital elements in understanding its trajectory. The analysis of LINK charts and patterns reflects broader sentiments within the crypto ecosystem, where a series of uptrends and retracements can signify important buying and selling opportunities. Analysts are particularly focused on key support levels, believing that a breach of these could lead to significant price adjustments or even a bullish turnaround in the near future. Furthermore, discussions around the Chainlink ecosystem are increasingly relevant, especially following its recent integrations into major payment platforms, which encourage new market engagement and investment influx. Overall, evaluating Chainlink through these lenses helps traders make informed decisions in a rapidly shifting environment.

Current Chainlink Price Analysis

Chainlink (LINK) has recently been affected by a bearish wave, which has seen it decline from its December peak of $29.28. The current market situation presents an opportunity for analysis, as LINK’s price has decreased over 56% since that high. Despite some analysts projecting a bullish turnaround, the overall sentiment in the crypto market remains cautious. The price is currently hovering around $12.91, reflecting the continued bearish pressure that farmers in the investor community face. Keeping an eye on LINK’s price action could unveil critical support and resistance levels essential for potential trading strategies.

Analysts believe that understanding the price movements in the context of broader crypto market trends is vital. The technical outlook indicates that if LINK can maintain its position above the crucial trendline support near $12.00, it may signal a recovery phase for the cryptocurrency. Conversely, slipping below this level could trigger further declines. Traders and investors should consider these factors while observing the LINK price movement and its implications on the market’s overall health.

Analyzing Chainlink’s performance reveals overarching trends influencing its price trajectory. Following the recovery patterns, LINK remains vulnerable while the overall sentiment reflects prevalent bearishness, marking it essential to strategize accordingly. The projections for a potential rise toward the $19 resistance level provide optimism, but current performance suggests a critical need to analyze immediate market changes.

Historical price patterns have often guided traders, as evidenced by past recoveries. The possibility of a bullish reversal hinges on the buying pressure at these threshold points, where the $12 support may indeed act as a pivotal point for a recovery strategy that extends beyond mere speculation. Understanding the fundamentals driving these trends will aid investors in making informed decisions.

Chainlink Market Trends and Future Projections

As we delve into the Chainlink market trends, it is crucial to recognize how external partnerships can significantly influence its price dynamics. The recent integration of Chainlink into PayPal’s ecosystem is a substantial milestone for LINK, introducing it to a broader audience and heightening its adoption. This partnership aligns with changing market behaviors where traditional finance intersects with the cryptocurrency realm, and it appears to have an optimistic effect on user sentiment.

Future projections for Chainlink indicate that, while the short-term outlook may still reflect bearish tendencies, the long-term analysis could unveil a more bullish trajectory. Analysts indicate potential price forecasts of $15.32 in the coming days, and $17.46 within a month, suggesting that despite current setbacks, there may be an upward tilt. Supporting these forecasts, the historical performance and recent integrations present a compelling case for bullish reversals.

The CONVERGENCE of market trends alongside emerging partnerships positions Chainlink as a potential frontrunner in crypto integrations. As the ecosystem becomes more entwined with robust financial platforms, the driving demand could sustain a surge in prices, as highlighted in LINK’s market analysis. Investors eagerly await confirmation from the 0.5 Fibonacci retracement levels, and potential bullish movements are closely tied to sustained market interest.

Continuous monitoring of these trends will shed light on how external factors like PayPal adoption play into LINK’s recovery narrative. The market responsiveness to these integrations demonstrates the potential for a significant turnaround should LINK maintain its foothold in pivotal price ranges.

However, the cautionary stance of the Fear & Greed Index at 26 serves as a reminder of the emotional landscape influencing investor behavior. As trends evolve, resilience in strategic approaches will be vital for navigating Chainlink’s price outlook.

Understanding Chainlink’s Bullish Reversal Potential

The potential for a bullish reversal in Chainlink’s price is increasingly becoming a focal point for traders and analysts. This anticipation is attributed to critical technical indicators suggesting that LINK might experience short-term gains, particularly if it successfully maintains support around the $12.00 trendline. Analysts like Ali Martinez have underscored this pivotal level in their Chainlink price analysis, hinting at the broader implications of such movements within the cryptocurrency ecosystem.

Moreover, historical price data suggests that a definitive bounce from this support could lead Chainlink towards higher resistance levels, paving the way for a possible return to the $19 range, provided that buying pressure is effectively generated. The correlation between market trends and price momentum reveals that many investors are currently waiting on the sidelines, assessing the market’s next moves before committing to longer positions.

Additionally, understanding the market landscape alongside the potential for a bullish turnaround requires an examination of the broader crypto sector. Chainlink’s position within this ecosystem, influenced by recent developments and partnerships, will be pivotal for its growth trajectory. Therefore, maintaining vigilance in market conditions will play an essential role as traders respond to both technical and fundamental analyses.

In conclusion, the bullish reversal potential hinges not only on robust price action but also on how effectively LINK can navigate current market sentiments. The interplay between trendline support and overall crypto market momentum will dictate Chainlink’s ability to rebuild itself in the coming trading sessions.

Chainlink Technical Outlook and Fibonacci Retracement Levels

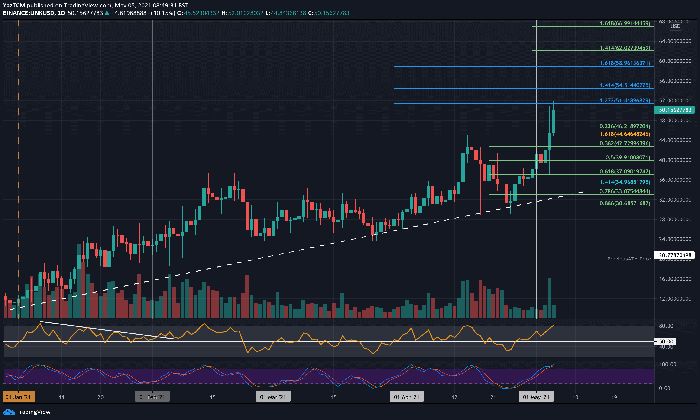

The technical outlook for Chainlink reveals crucial insights derived from Fibonacci retracement levels, which are essential in identifying potential support and resistance zones. Currently, LINK’s trajectory has been tested against the 0.5 Fibonacci retracement level near $12.00, marking a significant point for traders observing the altcoin’s movement. A bounce from this level may serve as a launchpad for LINK, potentially breaking through the resistance areas at approximately $19, creating fruitful trading opportunities.

Fibonacci levels provide a framework for predicting price movements, allowing investors to strategically plan entry and exit points based on historical price action. If Chainlink manages to hold above the $12 support, it fortifies optimism for further upside gains and illuminates the pathway for a bullish reversal. Conversely, failing to stabilize at this level may prompt a reevaluation of long positions, especially if declines materialize toward the critical $10 mark.

This intersection of technical analysis and established Fibonacci principles signifies the importance of both short-term trading opportunities and long-term investment strategies. Investors tracking LINK’s price levels can ascertain key thresholds that enhance their decision-making process.

Moreover, the chain’s volatility invites scrutiny into market dynamics, highlighting the necessity for risk management practices that align with these projections. How Chainlink responds to these technical benchmarks could elucidate its future performance in an evolving crypto market.

Chainlink Demand and Its Impact on Price Fluctuations

The growing demand for Chainlink, particularly in the wake of its recent integration into PayPal, highlights the intricacies of market sentiment that can influence price fluctuations. As more users gain access to LINK and engage with its capabilities, the potential for renewed buying interest arises, creating upward pressure on its price. Such demand dynamics are essential to consider within the broader context of Chainlink market trends, as heightened user engagement could foster substantial price action.

Conversely, the prevailing bearish sentiment casts a shadow on its potential. Reports indicate that numerous investors are currently hesitant, reflecting a cautious approach informed by the recent declines. Understanding these market behaviors is pivotal, as demand levels can often predict price behaviors amidst varying investor psychology. If the collective mood shifts towards increased optimism as demand rises, it may lay the groundwork for Chainlink price recovery.

In essence, the interrelation between demand and price volatility illuminates the underlying mechanisms driving the Chainlink market. Traders must remain alert to changing dynamics as new factors emerge, which could ultimately empower LINK toward more bullish trajectories.

Monitoring these shifts and strategically aligning them with technical analysis will be key in navigating Chainlink’s volatile landscape. Observing how demand correlates with price action can inform trader decisions on potential buy and sell opportunities.

Chainlink and Broader Crypto Market Analysis

The interconnectedness of Chainlink with broader cryptocurrency market dynamics emphasizes the importance of comprehensive market analysis. Recent performance figures indicate that while Chainlink has entered a bearish phase, its price movements are highly reflective of the sentiment permeating the entire crypto market. A widespread correlation exists among various cryptocurrencies that could influence LINK’s performance, raising questions about potential recoveries due to market-wide movements.

Analyzing Chainlink’s fluctuations within this framework requires careful scrutiny of market trends and sentiment indicators. As other assets fluctuate, Chainlink could either benefit or suffer from the prevailing environment, requiring traders to adapt their strategies accordingly. Observations regarding investor sentiment, akin to the Fear & Greed Index, showcase that a general atmosphere of fear may lead to conservative actions, influencing Chainlink’s immediate trading behavior.

In addition, trends within the cryptocurrency sector can provide insights into Chainlink’s future price trajectories. The synergy between LINK and the overall market emphasizes the need for traders to consider macro trends, alongside token-specific analysis.

Ultimately, success lies in aligning broader market indicators with targeted analysis of Chainlink’s behavior, allowing investors to navigate the complexities of its price movements amidst tumultuous conditions.

Frequently Asked Questions

What is the current Chainlink price analysis and market trend?

As of now, Chainlink (LINK) is trading at approximately $12.91, reflecting a slight decline of 0.62% over the last 24 hours. Despite a broader weekly gain in the crypto market, Chainlink has been under significant bearish pressure, losing over 56% since its peak of $29.28 in December. Technical analysis indicates that LINK is approaching a critical support level near the 0.5 Fibonacci retracement at $12.00, which could dictate the next market trend.

How does the LINK price forecast look in the near term?

According to leading crypto analysts, the Chainlink price forecast suggests a potential short-term recovery. Analyst Ali Martinez indicates that if LINK can maintain support above the $12.00 trendline, there is a possibility for a bullish reversal. This could lead to price targets of around $19, with even higher projections of up to $30 contingent on strong buying pressure.

What factors could lead to a Chainlink bullish reversal?

A Chainlink bullish reversal is contingent on maintaining critical support levels. Currently, LINK’s price is testing a crucial trendline support near the $12.00 mark. If the bulls can generate enough demand at this level, historical trends suggest a potential rally that could push Chainlink’s price towards $19 or higher. Additionally, the recent integration of Chainlink into PayPal’s ecosystem could bolster its market demand and contribute to a bullish trend.

What is the significance of the Chainlink technical outlook?

The Chainlink technical outlook is essential for understanding potential price movements. Analysts suggest that the current downward trend must hold above $12.00 to maintain bullish sentiment. The technical indicators, such as the ascending trendline and Fibonacci retracement levels, provide critical insights. Failure to maintain this support could lead LINK’s price to drop to around $10.00 or as low as $5.00, reinforcing the importance of these technical levels in price analysis.

What is the impact of the recent crypto market analysis on Chainlink’s price?

Recent crypto market analysis indicates that despite a positive overall trend, Chainlink is still experiencing significant bearish sentiment, with a Fear & Greed index of 26 showing extreme fear among investors. However, short-term predictions remain optimistic, with some analysts forecasting a rebound to $15.32 within five days and $17.46 in a month, as bullish scenarios suggest that LINK could find support and initiate a price recovery.

How will Chainlink being integrated into PayPal affect its price?

Chainlink’s integration into PayPal’s ecosystem is a significant development that is likely to enhance token demand and boost investor confidence. As PayPal users can now buy, hold, and send Chainlink, this could create additional market interest and potentially support a bullish trend in LINK’s price. Overall, such mainstream adoption can contribute positively to the Chainlink price analysis moving forward.

| Key Point | Details |

|---|---|

| Bearish Pressure | Chainlink (LINK) has seen a significant bearish trend, losing over 56% since a peak of $29.28 in December. |

| Potential Price Gains | Analyst Ali Martinez predicts potential short-term price gains for LINK, suggesting an upswing could occur. |

| Critical Support Level | The critical ascending trendline support is near the 0.5 Fibonacci retracement level at $12.00. |

| Price Forecast | A bounce at $12.00 could push LINK to $19 or potentially as high as $30, representing up to 147% increase. |

| Downside Risks | Falling below $12.00 could drop the price to $10.00 and potentially down to $5.00. |

| Integration with PayPal | Chainlink’s integration into PayPal will allow users to buy, hold, send, and receive LINK and SOL. |

| Current Pricing | LINK is trading at $12.91, with a 0.62% decline in the last 24 hours. |

| Market Sentiment | Investor sentiment is bearish with a Fear & Greed Index of 26, indicating extreme fear. |

Summary

Chainlink price analysis shows that despite recent bearish trends, there may be hope for recovery as crucial support levels are approached. With integration into mainstream platforms like PayPal, demand for LINK could increase, setting the stage for potential price rebounds. However, investors should remain cautious of downside risks if key support is breached.

Chainlink price analysis reveals a complex landscape for the altcoin, as it continues to navigate through bearish pressures while the broader crypto market enjoys some stability. After reaching a local high of $29.28 in December, LINK has since fallen dramatically, dropping over 56% and establishing a cautious downtrend. Despite these challenges, renowned crypto analyst Ali Martinez hints at a potential shift in the LINK price forecast, suggesting the possibility of short-term gains ahead. Analyzing the Chainlink technical outlook further, there are key indicators suggesting a potential bullish reversal, particularly if certain support levels hold. As traders look towards the Chainlink market trend, these insights could offer valuable guidance in a time of uncertainty for investors.

Exploring the recent fluctuations in the value of Chainlink, often referred to by its ticker LINK, sheds light on the current dynamics of this prominent cryptocurrency. The ongoing drop from its December peak raises questions about its future direction amidst a generally recovering crypto landscape. Industry experts, including notable analysts, are offering insights into potential upward movements, providing a nuanced look at the altcoin’s price forecast. With technical indicators pointing towards critical support zones, there’s growing interest in how a potential bullish turnaround could unfold in the near future. As traders and investors immerse themselves in this crypto market analysis, understanding these patterns becomes essential for informed decision-making.