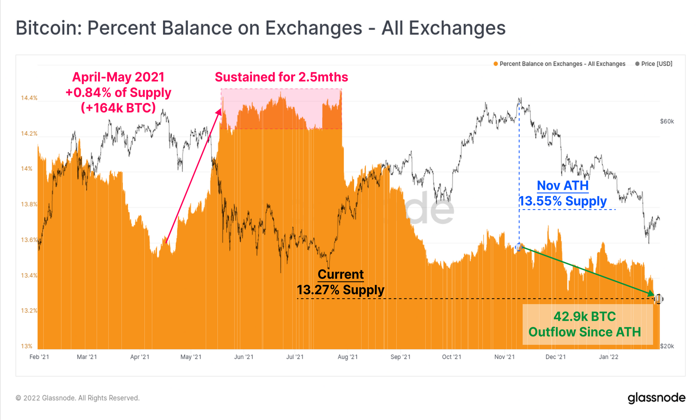

As Bitcoin supply on exchanges hits a five-year low, a notable trend is emerging in the cryptocurrency market. With only about 2.5 million BTC remaining on centralized platforms, signals suggest a significant shift in investor behavior toward self-custody Bitcoin solutions. This movement correlates strongly with institutional Bitcoin purchases, as major firms accumulate BTC and withdraw it from exchanges, resulting in diminished Bitcoin reserves. Such dynamics not only affect liquidity but may also contribute to increased Bitcoin price volatility as the market adjusts to this new landscape. As more investors opt for long-term holding of their digital assets, the market may be on the brink of transformative changes that could redefine existing trading patterns and valuations.

The diminishing Bitcoin availability on trading exchanges illustrates a pivotal moment in market conditions and investor strategies. Recent data highlights a pronounced trend toward storage solutions that prioritize ownership and security, such as self-custodied wallets. Institutional interest in this digital currency, characterized by large-scale acquisitions and less reliance on exchange liquidity, has major implications for Bitcoin market dynamics. As these entities continue to pull their assets away from exchanges, they create an environment ripe for potential supply constraints. This evolving landscape not only challenges the traditional frameworks of exchange trading but also opens avenues for unprecedented price fluctuations based on shifting supply and demand.

Understanding Bitcoin Supply on Exchanges and Self-Custody Trends

The trend of declining Bitcoin supply on exchanges is a noteworthy phenomenon that aligns with the growing interest in self-custody solutions among investors. As more individuals shift towards self-custody, they are opting to store their Bitcoin in private wallets rather than on centralized platforms. This movement is driven by a desire for enhanced security and control over their digital assets. As of April 2025, with Bitcoin reserves on exchanges plummeting to a mere 2.5 million BTC, it signals a clear preference among investors to hold onto their assets longer and avoid the risks associated with exchange-based storage.

Moreover, this transition is indicative of a broader maturation within the Bitcoin market. The increased self-custody translates not only to fewer coins available for quick trades but also signifies a more committed investor base. With less Bitcoin on exchanges, the potential for immediate market manipulation becomes reduced, paving the way for a healthier market dynamic. Such behavioral shifts may lead to a more stable price landscape as the influx of institutional players further cements Bitcoin’s status as a long-term investment rather than a short-term speculative asset.

Institutional Buying Spree and Its Impact on Bitcoin Prices

The heightened activity from institutional investors has drastically influenced the Bitcoin landscape. Notable firms like Fidelity are making significant Bitcoin purchases, which contribute to the supply constraints on exchanges. For instance, with Fidelity’s recent acquisition of $253 million in Bitcoin, the trend of institutional accumulation is clearly providing upward pressure on prices. This pronounced institutional interest signals confidence in Bitcoin’s potential, likely encouraging further investments from both retail and institutional sectors.

As institutional buying continues to outpace the available Bitcoin supply on exchanges, market analysts indicate that we could be on the brink of a supply crunch. This scenario is especially critical as it aligns with demand surges that typically drive Bitcoin prices higher. Many analysts have pointed out that the relationship between diminished supply and rising demand can lead to explosive price movements, especially in a market that has historically reacted strongly to similar conditions. Observing this dynamic, it remains crucial for investors to analyze how these trends could reshape Bitcoin’s price volatility in the coming months.

Exploring the Long-Term Effects of Bitcoin Exchange Supply Drop on Market Dynamics and Volatility

As Bitcoin supply on exchanges dwindles, we can expect significant long-term implications for market dynamics. Fewer coins available for trading means that the selling pressure decreases, potentially leading to price stabilization. This reduced risk of large sell-offs is crucial in a market typically characterized by volatility. Transitioning perspectives among investors also reflect a growing maturity in how Bitcoin is viewed: as a strategic asset akin to gold, rather than merely a speculative venture.

Furthermore, the notion that Bitcoin’s diminished supply could culminate in a supply shock emphasizes the underlying shifts in market behavior. With increasing scarcity, Bitcoin may achieve new heights, reflecting changes in both institutional strategies and retail investor sentiment. If demand remains robust during this constrained supply phase, we could anticipate Bitcoin navigating through price volatility cycles that are typified by sharp increases—often triggered by sudden demand surges. Therefore, these evolving market conditions could significantly redefine Bitcoin’s price trajectory, illustrating the delicate balance between supply and demand.

The Role of Institutional Bitcoin Purchases in Market Sentiment

Institutional Bitcoin purchases play a pivotal role in shaping market sentiment and fundamentally altering the dynamics of supply and demand. The increased acquisition by corporations and investment firms signals a robust confidence in Bitcoin’s future, setting the stage for more substantial market participation. Leading firms have withdrawn considerable amounts of Bitcoin from exchanges, further indicating that they perceive Bitcoin as a valuable asset for long-term holdings rather than fluid trading. Such motivations are essential to understanding the current bullish sentiment enveloping the Bitcoin market.

Furthermore, the influx of institutional capital into Bitcoin trading has amplified expectations regarding price movements among retail investors. As big players commit to acquiring Bitcoin, the perception that Bitcoin might achieve significant price increases contributes to a growing belief in its long-term viability. Consequently, as more institutions show interest in Bitcoin for portfolio diversification and as a hedge against inflation, the market sentiment shifts positively, encouraging both new and existing investors to participate more actively in this digital asset class.

Implications of the Bitcoin Supply Crunch on Future Price Trends

The recent drop in Bitcoin supply on exchanges profoundly impacts future price trends and volatility. With less Bitcoin available for immediate trading, the inherent scarcity may drive prices upward as demand from both retail and institutional investors continues to grow. Market analysts suggest that a supply crunch may trigger significant price movements. Historically, moments of constrained supply typically set the stage for bullish price action as eager participants vie for a limited number of assets. Accordingly, if buying pressure persists, Bitcoin could see prices move to new all-time highs.

Moreover, this impending supply crunch could promote a shift in market dynamics, where Bitcoin’s status evolves further into a hedge against economic uncertainties. The participation of institutional investors, increasingly viewing Bitcoin favorably for long-term strategies, may help stabilize price movements over time. As the market embraces this new equilibrium, Bitcoin could redefine how assets are perceived in the investment landscape, enabling traders and investors to recalibrate their approaches accordingly. Thus, understanding the implications of a supply crunch becomes crucial for navigating future Bitcoin price trends.

Navigating Bitcoin’s Price Volatility amidst Supply Reductions

Bitcoin price volatility is an inevitable element of its trading dynamics, especially with recent supply reductions on exchanges. When fewer coins are available, any significant increase in buying activity tends to amplify price swings. Traders and investors should remain vigilant, as these conditions often result in heightened reactions to market news or changes in investor sentiment. For instance, the recent trends toward self-custody and institutional accumulation have created a volatile yet potentially rewarding environment for investors.

Understanding these volatility patterns becomes essential for anyone looking to navigate the Bitcoin market effectively. The interplay of steadily declining exchange supplies coupled with increased institutional interest suggests a fertile ground for potential price surges. Participants in this market must weigh the risks associated with volatility against the opportunities presented by strategic long-term holding and potential gains during bullish periods. Ultimately, appreciating and adapting to the nuances of Bitcoin’s price volatility is key for successful investment strategies.

Frequently Asked Questions

What does the decline in Bitcoin supply on exchanges indicate about market trends?

The decline in Bitcoin supply on exchanges suggests a strong shift towards self-custody among investors. As more Bitcoin is moved into private wallets, it indicates a long-term bullish sentiment and a reduction in immediate selling pressure. This trend, driven significantly by institutional Bitcoin purchases, may lead to increased Bitcoin price volatility due to the constrained supply.

How have institutional Bitcoin purchases impacted supply on exchanges?

Institutional Bitcoin purchases have greatly impacted supply on exchanges, leading to a notable decrease in available Bitcoin reserves. Major firms like Fidelity have made substantial purchases, further diminishing the amount of Bitcoin held on exchanges. This accumulation reflects a growing trend of self-custody as institutions opt to withdraw their BTC from exchanges, contributing to a tighter supply that could influence Bitcoin market dynamics.

What are the implications of a low Bitcoin supply on exchanges for price volatility?

A low Bitcoin supply on exchanges can lead to increased price volatility. With fewer coins available for immediate sale, any surge in demand could result in significant price hikes. As institutional investors continue accumulating BTC and moving it into self-custody, the potential for supply shocks increases, which historically precede substantial price movements in the Bitcoin market.

Why are more investors moving Bitcoin into self-custody?

More investors are moving Bitcoin into self-custody primarily to secure their investments against market volatility and exchange vulnerabilities. This trend, part of a broader shift in Bitcoin reserves, reflects a growing confidence in Bitcoin as a long-term asset rather than a speculative tool. By self-custodying their Bitcoin, investors can better manage their holdings while also reducing exposure to potential liquidation risks associated with exchange balances.

What does the recent data on Bitcoin supply on exchanges reveal about future market behavior?

The recent data indicating that Bitcoin supply on exchanges has fallen to its lowest level since 2018 reveals that the market may be on the cusp of significant shifts. A reduction in available Bitcoin, coupled with rising institutional demand, suggests a potential for price increases due to constrained supply. Investors and analysts are closely watching these dynamics, as they could lead to increased Bitcoin price volatility and possibly set the stage for future market rallies.

| Key Points | Details |

|---|---|

| Bitcoin Supply on Exchanges | As of April 2025, the Bitcoin supply on exchanges has fallen to 2.5 million BTC, the lowest since 2018, indicating a significant decline of 500,000 BTC since the end of 2024. |

| Shift to Self-Custody | More investors are moving their BTC into self-custodial wallets, typically associated with long-term holding (HODLing), reducing the amount available on exchanges. |

| Institutional Accumulation | Major institutions, such as Fidelity, are purchasing Bitcoin in large quantities, contributing to the decline of Bitcoin supply on exchanges. |

| Market Implications | The decrease in available Bitcoin can lead to reduced selling pressure, potentially stabilizing prices and setting the stage for price increases if demand continues to rise. |

| Investor Sentiment | The trend towards self-custody reflects a maturing market where Bitcoin is increasingly seen as a strategic investment rather than a speculative asset. The bullish sentiment suggests possible price volatility due to limited supply. |

Summary

Bitcoin supply on exchanges has reached unprecedented lows, creating a significant shift in market dynamics. As institutional investors increasingly accumulate Bitcoin and the trend towards self-custody grows, the overall available supply on exchanges has diminished sharply. This situation not only enhances the potential for price volatility but also signals a growing recognition of Bitcoin as a valuable asset class. With a reduction in readily available Bitcoin, future demand surges could result in dramatic price increases, attracting more attention from both retail and institutional markets.

Bitcoin supply on exchanges has plunged to its lowest level since 2018, highlighting a significant shift in market behavior. Recent trends indicate that institutional Bitcoin purchases and a growing preference for self-custody Bitcoin are contributing to this decline, resulting in only 2.5 million BTC remaining on these platforms. As investors move their assets into self-custodial wallets, the dwindling supply on exchanges raises questions about future Bitcoin price volatility and market dynamics. With major firms like Fidelity actively acquiring large amounts of Bitcoin, this reduced availability may set the stage for supply shocks that could dramatically impact prices. Overall, the changing landscape of Bitcoin reserves signals a maturation in the cryptocurrency market, as more participants favor long-term holding over immediate trading.

The decreasing volume of Bitcoin stored on trading platforms reflects a broader transformation in how investors manage their digital assets. With many individuals and institutions gravitating towards holding Bitcoin in private wallets, there is a notable decrease in liquidity available for instant trading. This phenomenon, often referred to as a shift towards decentralized custody, is indicative of a maturing investment strategy as people increasingly recognize Bitcoin’s value as a long-term asset. Additionally, the activity of large institutional players further tightens market supply, potentially heralding a new era of Bitcoin investment characterized by less volatility and more sustained price growth. As the Bitcoin ecosystem evolves, its market dynamics are likely to become more robust, influenced by these emerging investment behaviors.