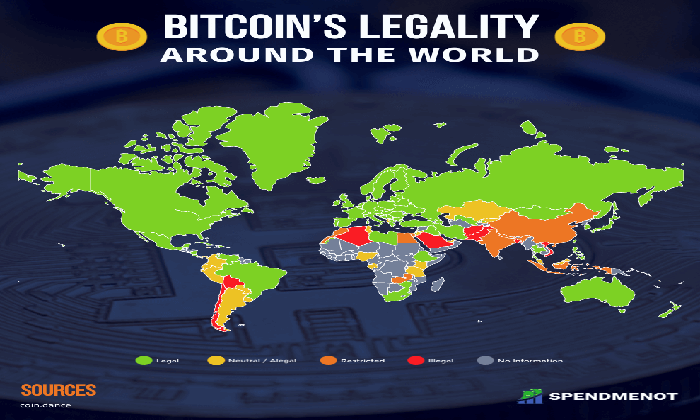

Bitcoin regulation has become a hot topic as the cryptocurrency landscape continues to evolve. With an increasing number of Bitcoin bills introduced across the United States, understanding US crypto legislation is essential for investors and enthusiasts alike. By April 2025, over 110 Bitcoin and digital asset bills have been proposed in 35 states, each reflecting unique approaches to crypto governance. As municipalities navigate the absence of comprehensive federal guidelines, state bitcoin laws are taking center stage, shaping local markets and defining the future of digital currency use. This article provides a state-by-state breakdown of these developments, offering crucial insights into the latest crypto law updates and emerging Bitcoin legislation.

As the realm of digital currencies expands, the regulation of Bitcoin becomes increasingly relevant. The patchwork of state-specific Bitcoin laws illustrates a varied local approach to cryptocurrency governance, impacting how citizens interact with digital assets. From tax implications to clarity on fraud and security, the updates in crypto laws reflect legislative attempts to keep pace with technological advancements. In this context, understanding the framework of Bitcoin legislation in 2025 is key for those looking to invest or participate in the crypto market. The ongoing changes underscore the importance of staying informed about regional regulations and the implications for future cryptocurrency dynamics.

Understanding Bitcoin Regulation in the United States

Bitcoin regulation in the United States is a complex landscape, shaped by both federal and state laws. Cryptocurrency regulation remains a hotbed for discussion, as various states take the initiative to introduce legislation related to Bitcoin and digital assets. This decentralized approach results in a patchwork of regulations, with each state having different laws regarding acceptance, taxation, and the definition of what constitutes digital currency. With over 110 Bitcoin bills introduced in 35 states, it is critical for investors and enthusiasts to stay informed about how these regulations may affect their usage and investment in Bitcoin.

The urgency for coherent Bitcoin regulations stems from the capacity of cryptocurrencies to disrupt traditional financial systems. As legal frameworks evolve, states like Wyoming and Texas have taken the lead in fostering Bitcoin-friendly environments, offering clarity to users and businesses alike. The ongoing changes reflect the importance of understanding local laws in conjunction with federal guidelines, ensuring stakeholders can navigate the legal intricacies that come with the embrace of Bitcoin in commerce and personal finance.

State Bitcoin Laws: A Regional Overview of Legislative Trends

State Bitcoin laws continue to evolve rapidly, with distinct trends emerging from different regions across the United States. In the Northeast, states have focused on consumer protection and providing clarity regarding taxation and reporting requirements for Bitcoin transactions. Meanwhile, states in the South have explored the possibility of state-sponsored digital currencies and the establishment of regulatory frameworks that support blockchain technology adoption.

In more regions, such as the Midwest, states are reflecting on how to leverage Bitcoin as a tool for local economic growth. This includes discussions on enabling institutional investments in Bitcoin and developing guidelines for decentralized finance platforms. By assessing these regional differences, stakeholders gain insights into potential investment opportunities and the future landscape of Bitcoin legislation as it becomes more mainstream.

Navigating US Crypto Legislation: Federal vs. State Authority

The distinction between federal and state authority in Bitcoin regulation is crucial for understanding how policies are enforced. Federal legislation lays a broad framework, often focusing on anti-money laundering and taxation issues, while state laws allow for a more tailored approach that can either support or hinder Bitcoin’s adoption. Since there is no singular federal law governing cryptocurrencies, states have taken it upon themselves to create an environment that suits their unique economic conditions and regulatory philosophies.

The current focus on state-by-state legislation has led to discrepancies and confusion for users. For instance, some states have sought to clarify legal definitions, while others have enacted sweeping bans. To navigate this complicated landscape, it’s crucial for investors and developers to stay updated on both federal directives and state-specific Bitcoin laws, ensuring compliance while taking advantage of potential benefits offered at the state level.

Recent Bitcoin Legislation Initiatives and Developments

As of April 2025, the landscape of Bitcoin legislation in the US is continually changing, with recent initiatives aimed at modernizing outdated financial laws. States are increasingly recognizing the necessity of clear regulatory guidelines to foster innovation while protecting consumers. Initiatives such as the introduction of bills that focus on Bitcoin taxation and potential legal exemptions for transactions are just some examples of ongoing progress.

Additionally, states are collaborating more with technology leaders in the crypto space to better understand the implications of Bitcoin in economic terms. This has led to the drafting of bills that not only seek to regulate Bitcoin but also promote its use as a legitimate financial asset. As these legislative measures move through various committees, the outcomes will have significant implications for how Bitcoin is perceived and utilized across the nation.

Key Takeaways from the Bitcoin Legislation Report of 2025

The Bitcoin legislation report of 2025 illustrates significant momentum towards embracing Bitcoin across multiple jurisdictions within the US. Key takeaways include the importance of tracking state-specific developments in legislation that directly affects the use and perception of Bitcoin. With more than 110 bills on the table, the report emphasizes that stakeholders must remain vigilant and informed about evolving laws, as these can greatly influence market dynamics.

Investors and users should also recognize the disparities between states and the ongoing efforts to unify regulatory approaches. Each state’s legislation may create different opportunities and risks, which can affect everything from investment strategies to compliance requirements. By staying informed on this legislative front, particularly regarding upcoming Bitcoin bills and state laws, individuals and businesses can position themselves effectively for the future of cryptocurrency.

The Role of Federal Authority in Shaping Bitcoin Legislation

The role of federal authority in shaping Bitcoin legislation cannot be understated, as it serves as the backbone upon which state regulations are built. Federal regulations primarily focus on overarching concerns such as security, fraud prevention, and market integrity. This creates a baseload of compliance that all states must adhere to, even as they develop their standards and regulations. The challenge for federal regulators is balancing innovation with necessary protections, ensuring that Bitcoin can flourish without compromising the financial system.

However, the absence of definitive federal legislation specifically targeting cryptocurrencies has allowed states to experiment with different approaches at their discretion. This state-centric narrative carries both pros and cons; while it allows innovation and rapid response to technological advancements, it can also lead to a fragmented market that complicates compliance for businesses operating across state lines. The tension between federal oversight and state autonomy will ultimately define the future of Bitcoin regulation.

Bitcoin Bills: Analyzing Key Legislative Proposals State-by-State

In analyzing key legislative proposals related to Bitcoin on a state-by-state basis, it becomes clear that states are taking varied approaches based on local economic conditions, political climates, and public sentiment towards cryptocurrencies. For example, states such as Ohio have proposed bills that facilitate tax payments in Bitcoin, demonstrating a growing acceptance of digital currencies in mainstream finance. In contrast, others have introduced strict regulations aimed at maintaining control over the financial ecosystem.

This variance in legislative proposals underlines the necessity for ongoing discussions about best practices among states and the implementation of a coherent strategy that can effectively govern Bitcoin. By evaluating these key legislative proposals, industry participants can better understand what drives state laws and anticipate changes that could impact Bitcoin’s evolution in the American market.

Future Directions for Bitcoin Law and Legislation

Looking ahead, the future direction of Bitcoin law and legislation will likely revolve around increased federal involvement and an eventual push for a comprehensive regulatory framework. As more users enter the cryptocurrency market and Bitcoin continues to gain mainstream acceptance, the urgency for cohesive policies that protect consumers and investors while fostering innovation is paramount. Legislative bodies are expected to explore regulatory harmonization to eliminate confusion surrounding state laws, driving greater clarity for stakeholders.

Moreover, as technology evolves, so too will the discussions surrounding Bitcoin regulation. Topics like decentralized finance, the implications of blockchain technology, and the intersection of Bitcoin with traditional finance will be at the forefront of new legislative proposals. Investors, regulators, and advocates must monitor these trends closely to ensure that Bitcoin remains a viable and secure option in the financial landscape.

The Impact of Legislation on Bitcoin Adoption and Innovation

The impact of legislation on Bitcoin adoption and innovation is profound, influencing how businesses and consumers engage with cryptocurrency. Effective regulations can provide necessary legal frameworks that foster trust and encourage wider acceptance of Bitcoin as a legitimate financial asset. Conversely, overly restrictive practices may stifle innovation, drive investment away, and hinder the progress of blockchain technology.

As states continue to introduce Bitcoin bills and refine their legislation, the balance between stringent regulatory frameworks and innovation will be critical. By supporting a legislative environment that encourages experimentation and adoption, states can position themselves as leaders in the blockchain and cryptocurrency sectors while ensuring that consumer protection remains a priority. Observing how legislation unfolds will be essential for investors and businesses looking to capitalize on Bitcoin’s potential.

Frequently Asked Questions

What are the current Bitcoin regulations in the US as of 2025?

As of April 2025, over 110 Bitcoin and digital asset bills have been introduced across 35 US states, reflecting a diverse array of legislative approaches to Bitcoin regulation. These range from state investments in Bitcoin to clearer tax guidelines and criminal laws related to cryptocurrency.

How does federal vs. state law affect Bitcoin regulation?

The ambiguity in federal Bitcoin regulation has prompted individual states to enact their own Bitcoin regulations. This state-driven approach allows for a patchwork of laws governing Bitcoin and digital assets, with each state tailoring its legislation to its unique economic interests and concerns.

What are some key Bitcoin bills in different states?

Key Bitcoin bills vary significantly from state to state. For instance, certain states have proposed legislation to allow state investment in Bitcoin, while others focus on tax treatment and compliance requirements for cryptocurrency transactions. Reviewing recent legislative summaries on Bitcoin regulation will provide insights into the current status of these bills.

Where can I find detailed updates on Bitcoin legislation state by state?

CryptoSlate provides a comprehensive report that includes a state-by-state breakdown of Bitcoin legislation in the US. This report captures recent developments in Bitcoin regulation, including summaries of various bills and their statuses.

What is the role of state bitcoin laws in 2025?

State Bitcoin laws in 2025 are crucial because they fill the legislative void left by unclear federal regulations. These laws enable states to manage Bitcoin utilization, encourage innovation, and address specific regulatory needs tailored to local markets.

How do Bitcoin legislation updates affect investors?

Updates to Bitcoin legislation can significantly impact investors by shaping the regulatory landscape. Clearer laws may enhance market confidence, while restrictive regulations could create barriers to entry or necessitate compliance adjustments for investors.

What is the significance of state bitcoin laws in the context of US crypto legislation?

State bitcoin laws are significant in the context of US crypto legislation because they represent localized attempts to establish regulatory frameworks, thereby influencing how Bitcoin is treated for investment, tax, and legal purposes in different jurisdictions.

Where can I access recent research on Bitcoin regulation and legislation?

Recent research and comprehensive insights on Bitcoin regulation can be accessed through CryptoSlate’s Alpha membership, which offers exclusive updates on Bitcoin legislation and other crypto-related topics.

| Section | Key Points |

|---|---|

| Introduction | Overview of Bitcoin regulation efforts across 35 US states, with over 110 bills introduced. |

| Federal vs. State Law | Explains the distinction between federal and state authority regarding Bitcoin legislation. |

| Regional Breakdown | Legislation categorized by US Census regions, highlighting relevant bills and their statuses. |

| Sources of Information | Links to full bill texts and legislative pages for detailed reading. |

| Conclusion | The report indicates varied Bitcoin regulations are emerging as states respond to the absence of federal clarity. |

Summary

Bitcoin regulation is a crucial topic as different states in the U.S. pursue their legislative paths amidst a lack of federal consensus. The recent report by CryptoSlate reveals that more than 110 Bitcoin bills are actively shaping the regulatory landscape across 35 states. These efforts underscore the dynamic and fragmented nature of Bitcoin legislation, inviting further exploration and understanding from stakeholders and observers.

Bitcoin regulation has become a critical focus as the cryptocurrency landscape continues to evolve rapidly. In 2025, US lawmakers introduced over 110 Bitcoin bills across 35 states, addressing key issues such as state investments and tax treatments for digital assets. This wave of US crypto legislation reflects the growing recognition of Bitcoin’s significance in the financial ecosystem and the necessity for regulatory clarity. As states navigate their own Bitcoin legislation, varying approaches can lead to a patchwork of rules that impact investors and businesses alike. Understanding these developments in Bitcoin regulation is essential for staying informed about the legal landscape surrounding digital currencies.

When discussing the framework governing Bitcoin, terms like crypto compliance and digital asset laws come to the forefront. The increased legislative focus on Bitcoin and alternative cryptocurrencies has prompted a surge in regional initiatives, creating a complex tapestry of state bitcoin laws across the US. As policymakers respond to the unique challenges posed by cryptocurrencies, updates on crypto legislation become essential for stakeholders. A comprehensive review of the various Bitcoin bills, particularly as we approach 2025, reveals a landscape eager for balance between innovation and protection. As more states craft their own regulations, keeping track of these developments will be vital for anyone involved in the cryptocurrency market.

Leave a Reply