Bitcoin market analysis is essential for understanding the dynamics of this leading cryptocurrency, particularly amidst its recent fluctuations. As Bitcoin (BTC) hovers around the $84,942 mark, investors are analyzing key indicators like Bitcoin price analysis to detect trends and potential buying opportunities. Despite its realized cap reaching an unprecedented $872 billion, market sentiment remains cautious, with many observing BTC trading trends closely. The presence of Bitcoin dip buyers at current range lows reflects a risk-averse approach as they await confirmation of strong support levels around the $90K threshold. This market environment underscores the importance of tracking cryptocurrency patterns to navigate the complexities of Bitcoin investment effectively.

An extensive examination of Bitcoin’s market trends reveals critical insights into the cryptocurrency’s performance, particularly for potential investors. The analysis of BTC price movements and trading behavior offers a window into the collective sentiment affecting market stability. With the cryptocurrency experiencing significant volatility, understanding buyer behavior—such as the hesitance of Bitcoin dip purchasers—is crucial for anticipating market shifts. Additionally, observing support dynamics and changes in trader attitudes can lead to more informed decisions in what can often be a tumultuous trading environment. By leveraging alternative analytical perspectives, investors can better position themselves within the evolving landscape of digital currencies.

Understanding Bitcoin Market Analysis

Bitcoin is currently at a significant juncture where market analysis has become crucial in guiding investor decisions. Analyzing trends in the Bitcoin market involves evaluating various factors such as trading volumes, price movements, and investor sentiment. With Bitcoin currently valued around $84,942 and a recent stability observed within a tight range, market analysts are paying close attention to BTC’s behavior in the context of broader cryptocurrency market dynamics.

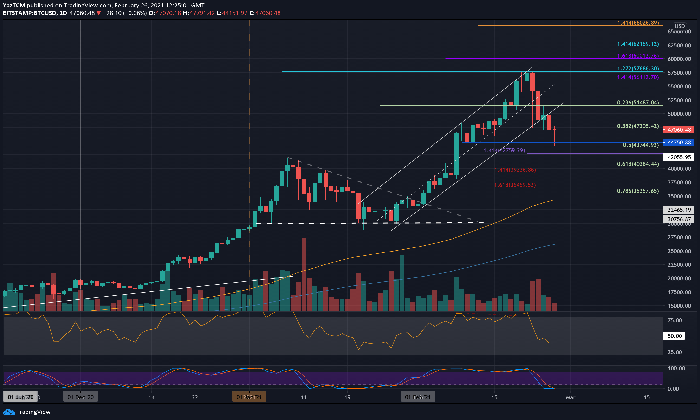

One of the critical components of Bitcoin market analysis includes monitoring support levels and resistance points. As mentioned, BTC is hovering just above notable support from the 50-day, 100-day, and 200-day moving averages, creating a landscape where cautious buyers may look for signals before making any commitments. This analysis indicates that while there is potential for upward movement, the risk-averse sentiment may caution buyers until safer support levels are confirmed.

Frequently Asked Questions

What is Bitcoin market analysis and why is it important for understanding BTC trading trends?

Bitcoin market analysis involves studying the trends and patterns in Bitcoin’s price movement, market sentiment, and trading activities. It is important for understanding BTC trading trends because it helps investors and traders identify potential market opportunities, assess risks, and make informed decisions about buying or selling Bitcoin. By analyzing various factors like price support levels and market sentiment, traders can strategize effectively.

How can Bitcoin price analysis help investors decide on BTC dip buying strategies?

Bitcoin price analysis is crucial for investors considering BTC dip buying strategies. It provides insights into support levels and market behavior during price drops. For instance, identifying recent support levels can help determine optimal entry points for purchasing Bitcoin at lower prices. Furthermore, analyzing market sentiment alongside Bitcoin price trends allows investors to gauge the potential risk and volatility associated with such decisions.

What are the signs of risk-averse Bitcoin dip buyers in the current market analysis?

Current Bitcoin market analysis indicates that risk-averse dip buyers are carefully evaluating BTC’s price movements around the recent range lows. Specific signs include the cautious stance of buyers due to the $90K support level, combined with a slowdown in realized capital growth and the high percentage of short-term holders facing losses. This highlights a hesitance to invest heavily until clearer bullish signals emerge.

How does cryptocurrency market sentiment impact Bitcoin price movements?

Cryptocurrency market sentiment plays a significant role in Bitcoin price movements. When sentiment is positive, more investors are likely to buy BTC, driving prices up. Conversely, negative sentiment may lead to selling pressure, causing prices to drop. The recent analysis revealed a risk-off market sentiment, characterized by slowing growth and profit-taking among traders, which indicates that sentiment can directly influence Bitcoin’s fluctuations.

What do the current Bitcoin support levels indicate for future market trends?

Current Bitcoin support levels are crucial indicators for future market trends. BTC sustaining support from 50-day, 100-day, and 200-day moving averages suggests a potential for stabilization around those levels. However, with resistance ongoing in the daily structures, it indicates that while there is support for buyers, prevailing resistance levels pose challenges for significant upward movement in the near future.

| Key Point | Details |

|---|---|

| Bitcoin Price | Currently valued at $84,942 with a 24-hour change of 0.80%. |

| Realized Market Cap | Reached an all-time high of $872 billion, but shows a slow monthly growth rate of 0.9%. |

| Market Sentiment | Indicators of a risk-off market sentiment include profit-taking and underwater short-term holders. |

| Investor Activity | Realized profit/loss has dropped by 40%, indicating possible saturation in investor activity. |

| Short-Term Holder Price | The short-term realized price is $91,600, meaning current trading below this price may lead to selling pressure. |

| Investor Divergence | US market shows strong demand with a rising Coinbase premium, while Korean traders show declining engagement. |

| Price Range | Bitcoin has been trading within a narrow range of $85,440 to $82,750 since April 11. |

Summary

Bitcoin market analysis indicates that while there is cautious interest from dip buyers exploring range lows, the prevailing sentiment remains risk-averse. The market shows signs of slowing growth, particularly with an all-time high realized cap but low investor enthusiasm. With current prices below key support levels and profit-taking behavior evident, potential new investors may be hesitant, while existing investors are likely to act cautiously. As the market seeks a new equilibrium, understanding these dynamics is crucial for anyone involved in Bitcoin trading.

Bitcoin market analysis has become crucial as traders and investors navigate the complexities of cryptocurrency trading. Currently, Bitcoin (BTC) is valued at approximately $84,942, reflecting a 0.80% change over the past 24 hours amidst significant market fluctuations. Despite Bitcoin’s realized cap reaching an all-time high of $872 billion, the market sentiment remains cautious as profit-taking and underwater short-term holders dominate discussions. As the demand for BTC shows signs of slowing, understanding Bitcoin price analysis, support levels, and BTC trading trends is vital for prospective dip buyers. Investors must remain vigilant, as the state of the cryptocurrency market heavily influences trading behavior and sentiment across the board.

Analyzing the Bitcoin market presents an intricate tapestry of trading patterns and investor psychology. This examination not only delves into the current price fluctuations of BTC but also explores the broader cryptocurrency landscape, including the underlying factors affecting market sentiment. With Bitcoin dip buyers increasingly vigilant, alternate terminologies such as cryptocurrency valuation trends and digital asset support thresholds come into play. Identifying the key indicators, such as the realized cap and positions of short-term holders, becomes essential for those involved in BTC trading. Through comprehensive market evaluation, traders can uncover patterns that inform their investment strategies.